Pre-approval for a home loan is not just a basic preliminary step; it’s a strategic advantage that can significantly enhance your position in a competitive property market. It provides a significant layer of clarity, confidence, and leverage, transforming you from a prospective buyer into a serious contender. For prospective homeowners, a home loan pre-approval is quite a powerful tool, signaling to real estate agents and sellers that you are a qualified and committed buyer. This can be the difference between your offer being considered and being overlooked, especially in markets with high demand.

Pre-approval is an initial assessment by a lender, strictly confirming how much you can borrow before you even begin your property search. This process greatly involves a detailed review of your financial situation, like your income, savings, assets, and liabilities. The result is a formal document that states the maximum amount the lender is willing to lend you. This step is a cornerstone of the OM Financials approach, which is built on the principle of being a “one-stop solution” for all your lending needs.

Key Advantages That Set You Apart in Your Home Loan Pre-Approval Journey

Pre-approval provides several tangible benefits that go beyond just knowing your budget.

1. Financial Clarity and Confidence: It removes the guesswork from your property search. You know your exact borrowing capacity and can filter your search to properties within your price range, saving you time as well as preventing the heartbreak of falling in love with a home you can’t afford. This knowledge basically empowers you to bid confidently at auctions or negotiate with a firm hand on a private treaty sale.

2. Faster and More Efficient Process: With pre-approval, you have nearly completed the bulk of the paperwork. Your financial history, in conjunction with credit checks and income verification, has all been processed. This clearly means once you find your dream home, the final approval process is significantly quicker, reducing the stress and potential delays that can derail a sale. In a market where multiple buyers are vying for the same property, a streamlined, fast-moving offer is a major asset.

3. Strengthened Negotiation Position: Knowing your budget primarily gives you the upper hand in negotiations. Real estate agents are more inclined to work with pre-approved buyers because there is a higher certainty of the sale proceeding. This can give you an edge over other bidders, even if your offer is slightly lower, because it represents a surer path to a closed deal. Pre-approval demonstrates your financial seriousness and commitment.

Navigating the Market for Home Loan Pre-Approval with Confidence

Having a pre-approval letter in hand changes your entire home-buying experience. It transforms a stressful and uncertain process into a strategic mission. Real estate agents are more willing to show you properties and take your offer seriously when they see you are a pre-approved buyer. This is because they know you are a low-risk client who can move forward quickly. This level of credibility can make a significant impact on your ability to secure the home you want, especially in a seller’s market where competition is fierce.

Furthermore, the pre-approval process itself is a valuable learning experience. It gives you a clear picture of your financial standing as well as allows you to address any potential issues with your credit history or debt-to-income ratio well before you submit a formal application. This proactive approach saves time and avoids potential rejections, ensuring a more seamless transaction.

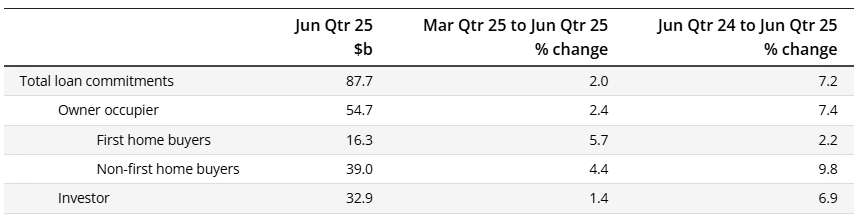

Statistical Insights into the Australian Home Loan Pre-Approval Market:

Based on historical trends, data from these sources consistently shows that a higher number of pre-approved buyers leads to a more efficient and confident market. This is because pre-approved buyers reduce fall-through rates, resulting in more certain transactions and a stronger, more stable market.

Source: Australian Bureau Statistics(ABS)

The data from the Australian Bureau of Statistics (ABS) greatly highlights a market with steady growth in both the number & value of loan commitments. The notable increase in the value of first-home buyer loans signals a competitive environment where buyers are securing larger loans to enter the market.

OM Financials: Your Professional Buyers Agent for Home Loan Pre-Approval

The complexities of home loans can be quite perplexing. That’s where a proficient professional buyer’s agent becomes an incredibly invaluable asset. Here the buyer’s agent basically acts as your advocate, working on your behalf to secure the best possible pre-approval. At OM Financials, we truly believe in a relationship-driven approach to finance. We don’t just process your application; we partner with you to understand your unique needs and goals. Our expert buyers agents take the time to guide you through every step of the pre-approval process, making certain you are fully informed and prepared.

Path to a Seamless Home Buying Journey: Ready to Gain Your Competitive Edge?

Securing pre-approval for your home loan is more than just a smart move—it is an essential strategy for navigating today’s competitive property market. Whether you’re a first-time home buyer in search of home loans in Kellyville Ridge or looking for a mortgage broker in North Kellyville to guide you, this crucial step basically gives you the confidence and leverage to act decisively. Our team also specializes in construction loans for Kellyville new builds and can help you refinance your home loan in Kellyville Ridge. Partner with OM Financials today to turn your homeownership dreams into a reality.Call now at +61-478-876-967 or book your free consultation call briskly and embark on the first, most important step toward home ownership.