Entering the housing market can feel like traversing a complicated labyrinth. With fluctuating prices, competitive bids, and a sea of loan options, the journey to homeownership can be daunting. Furthermore, there’s a powerful tool that can not only simplify this process but also deliver substantial financial savings: mortgage pre-approval. This is not just a formality; it is a strategic advantage that can place you ahead of the competition and prevent costly financial pitfalls. For aspiring homeowners, obtaining pre-approval is not merely a preliminary step; it’s a strategic move that can literally save you thousands of dollars, placing you in a stronger, more confident position.

This process basically involves a comprehensive review of your financial history, including your income, expenses, assets, and liabilities. This is where OM Financials comes in. At OM Financials, we believe and also understand that securing a home loan is not a one-size-fits-all process. Our approach is rooted in partnership to navigate the complexities of lending, making certain you are not just approved but armed with some of the best possible financial strategies.

The Power of Pre-Approval: More Than Just a Number

Many people confuse pre-qualification with pre-approval. While pre-qualification gives you a rough estimate of what you might be able to borrow based on self-reported information, pre-approval is a detailed, formal process. It basically involves a lender verifying your financial situation—including your credit history, income, and assets—to determine the precise amount you can borrow. This results in a letter of commitment from the lender, stating the exact loan amount they are prepared to offer you.

This document serves as a powerful testament to your financial readiness. When you make an offer on a home, a seller will view your pre-approval letter as a sign of a serious, credible buyer, firmly giving you quite a competitive edge over those without it.

How Pre-Approval Leads to Financial Savings

The savings from pre-approval are likely to extend far beyond winning a bidding war. Here is a breakdown of how this simple step can protect your finances:

- Securing a Favorable Interest Rate: The pre-approval process primarily includes a firm interest rate offer, which is often locked in for a specified period (e.g., 60-90 days). This protects you in a certain manner from potential rate increases while you are house hunting. In a market with fluctuating interest rates, this can truly save you thousands of dollars over the life of your loan.

- Budgeting with Precision: Knowing the exact amount you can borrow allows you to focus your search on homes within your budget. This clearly prevents you from falling in love with a property you can’t afford, saving you from emotional overbidding. It also gives you a clear understanding of your price ceiling, allowing for focused negotiations.

- Leveraging Negotiating Power: With a pre-approval letter, you can approach sellers meticulously with great confidence. In some cases, a seller may be more willing to accept a slightly lower offer from a pre-approved buyer, since the risk of the deal falling through is nearly minimal. This can give you leverage to negotiate on price, closing costs, or other terms too.

- Avoiding Unnecessary Fees: Without pre-approval, the house hunting process can be scattered. You might spend money on multiple property inspections, appraisals, and legal fees for homes that ultimately fall through because of a loan denial. Pre-approval streamlines the process in a specific manner, ensuring you only spend money on properties you can realistically buy.

- Saving Time and Stress: Time is money, and the stress of an uncertain financial situation can be a significant cost in itself. Pre-approval saves you countless hours of uncertainty and reduces the stress of the home-buying journey, strictly allowing you to focus on finding the perfect home rather than worrying about the financing.

The Power of Pre-Approval: Statistical Insights

The power of pre-approval is not just anecdotal; it is strongly supported by hard data from reputable sources like the Australian Bureau of Statistics (ABS). As home loan applications together with approvals fluctuate with market conditions, understanding the trends reinforces the importance of being prepared.

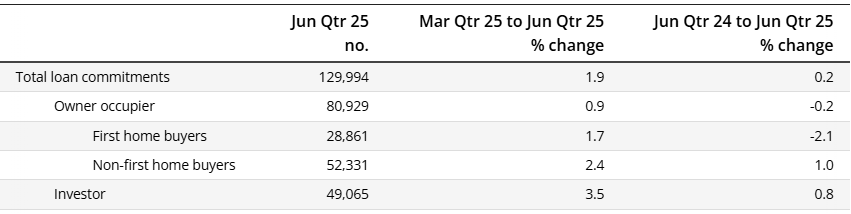

Source: Australian Bureau of Statistics

This data indicates a steady market, with both owner-occupier and investor activity showing positive growth in the June quarter of 2025. The number of first-home buyer loan commitments also increased, suggesting that even in a competitive environment, new buyers are entering the market successfully.

Why Partnering with OM Financials Is the Smart Choice

The process of securing pre-approval requires more than just filling out forms. It requires a partner who understands your unique financial situation and the nuances of the market. At OM Financials, our experienced financial consultants act as your long-term partners, not just transaction processors. We firmly believe in building relationships based on trust, integrity, and radical responsiveness that align with your financial goals, ensuring you have the support you need from the first consultation to the final closing.

Final Thoughts: Your Pathway to a Smarter Purchase

Securing mortgage pre-approval is a crucial step that can transform your home-buying experience, basically offering significant financial advantages & peace of mind. Whether you are a first home buyer in Schofields or planning to build in the Riverstone new estates, obtaining pre-approval is a strategic move that provides a competitive edge and substantial savings. For adept professional guidance on home loans in the Riverstone development and beyond, partner with a trusted mortgage broker near Schofields station.Call now at +61-478-876-967 or book your free consultation call with OM Financials with OM Financials and take the first step toward a smarter, more secure home purchase.