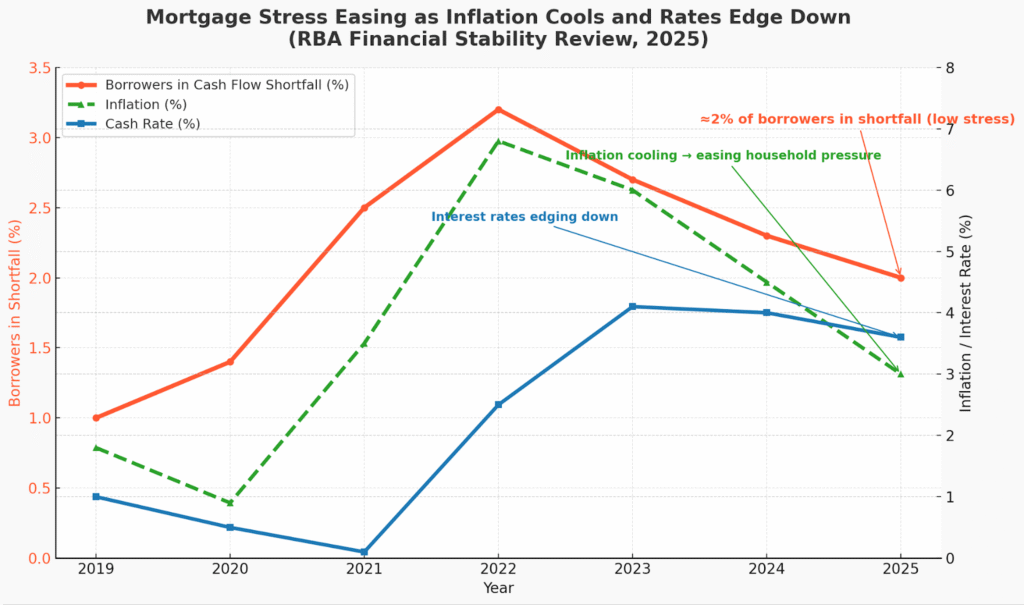

Australian homeowners are finally getting some breathing room with their finances. The Reserve Bank of Australia’s latest Financial Stability Review shows that household budgets are looking healthier as inflation cools and interest rates edge down. Only around 2% of variable-rate mortgage holders are currently in a cash flow “shortfall” (where essential expenses plus loan payments exceed income) – a small share that has declined from its peak last year. In other words, the vast majority of borrowers are keeping up with their mortgages, and overall mortgage stress remains very low by historical standards.

Steady Repayments and Low Arrears

It’s not just day-to-day cash flow that’s improving – home loan arrears are low and stable. The share of mortgages over 3 months in arrears has settled at about pre-pandemic levels. Another safety net has been homeowners’ savings and offset account buffers. Many households built up extra savings during COVID, and they’ve maintained large liquidity buffers since. In fact, the typical mortgage holder’s prepayment buffer is higher now than before the pandemic. These savings stashes (along with solid home equity) mean that even if finances get tight, most people have a cushion to draw on. Less than 1% of households are in negative equity (owing more than their home’s value), which is lower than before the pandemic – a testament to how much equity many owners have thanks to past price gains and diligent repayments.

Of course, not everyone is entirely out of the woods. Highly leveraged borrowers. The high loan-to-value (LVR) or high debt-to-income (DTI) loans are still a bit more prone to falling behind. Arrears rates for these groups (and for lower-income borrowers) remain higher than for other borrowers and higher than pre-2020 levels, even though they have declined over the past year.

Investors Returning as Rates Fall

Another trend to note: property investors are slowly coming back into the market. Historically, when interest rates drop, investors take it as a green light, and that pattern is emerging now. The RBA reports that investor housing credit growth has picked up and is running above its post-GFC average. With borrowing costs easing and property listings still tight in many areas, investors see an opportunity – which could heat up competition for certain properties.

For would-be home buyers, this means you might face more bidders at auctions or need to act faster, as investors re-enter with renewed confidence. The flip side is that investor loans have historically had slightly lower default rates, but if investors pile in and push prices up rapidly, it’s something regulators watch closely. For now, this investor uptick is a sign of improving sentiment thanks to cheaper loans. If you’re an owner-occupier, don’t be surprised if the market feels a bit more crowded as interest rates come down.

Whether you’re refinancing, investing, or buying your first home, now is a great time to review your options and plan ahead. We OM Financials, make the loan process simple and support you every step of the way. We are always here to help you. You can now book your free consultation or call us on 0478 876 967