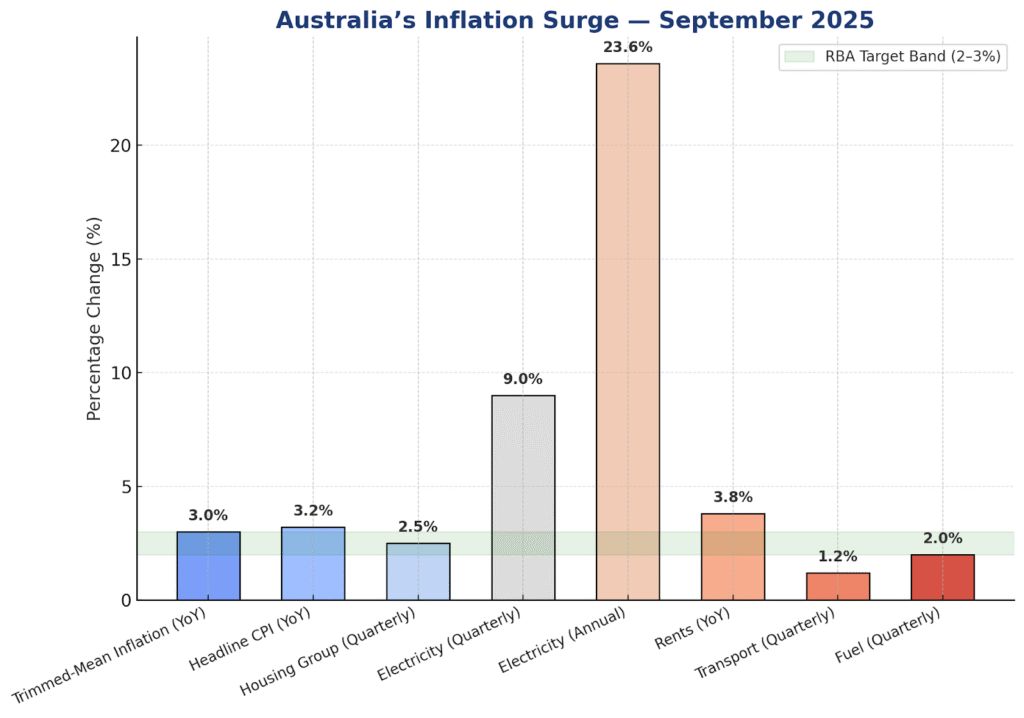

Recent data show a surprise jump in inflation, delaying any rate cuts. In the September 2025 quarter, the RBA’s preferred measure – trimmed-mean inflation – rose to 3.0% (up from 2.7%), the first rise since late 2022. Overall CPI inflation also accelerated to 3.2%, the fastest pace since mid-2024. Much of this was driven by housing and utility costs. For example, electricity prices alone jumped 9.0% in the quarter (about 23.6% over the year), largely because one-off rebates faded. Other everyday costs ticked up too (transport +1.2% this quarter). In short, prices are proving more stubborn than expected.

- Inflation data: Trimmed-mean inflation is 3.0% (Sept qtr, YoY); headline CPI is 3.2%.

- Housing & utilities: The housing group rose 2.5% this quarter (mainly electricity +9.0%). Over 12 months, housing costs are up 4.7% (electricity +23.6%, rents +3.8% YoY).

- Other costs: Transport prices +1.2% this quarterabs.gov.au (fuel +2.0%).

Impact on Home Loan Rates

Higher inflation means interest rates are likely to stay put for longer. Economists and banks now expect the RBA to hold its cash rate at 3.60% for the foreseeable future. In a Reuters poll, all surveyed economists forecasted no change. Major banks (CBA, Westpac, NAB, ANZ) have pushed their first rate-cut forecasts into early-to-mid 2026. In short, any chance of a quick cut has faded.

- Rates to hold: With inflation near the top of the RBA’s target band, forecasts see the cash rate staying at 3.60%. Most economists now expect the first cut only by mid-2026.

- Longer stability: Borrowers should prepare for a longer stretch of steady rates. Quick cuts are off the table, so plan for rates to remain high for now.

- Review your loan: Now is a good time to check fixed vs variable rates. If a fixed term is ending, consider locking in a new fixed rate. If you’re on a variable rate, talk to your broker about splitting the loan or fixing part of it.

- Refinancing opportunities: Many borrowers will start shopping for better deals. Comparing home loans across lenders can save you money while rates stay high.

- Budget properly and carefully: The major concern that you cannot miss in inflation is affordability. Yes, you need to be so sure on managing mortgage payment and rising bills. Brokers can help you plan for steady payments amid higher costs.

Having mortgage brokers available will help over time, we can assist in finding loan features and lenders that work within your expected cash flow needs in a rising interest rate environment and inflationary climate.

Need Help with Your Home Loan?

At OM Financials, we are there to guide you through the lending process in a simple manageable way. Our brokers can look at your current position and discuss your borrowing options, deposit strategies, and LVR strategies to help you move forward feeling confident. Call us at 0478 876 967 today or book a free strategy to determine how much you can borrow in the current market.