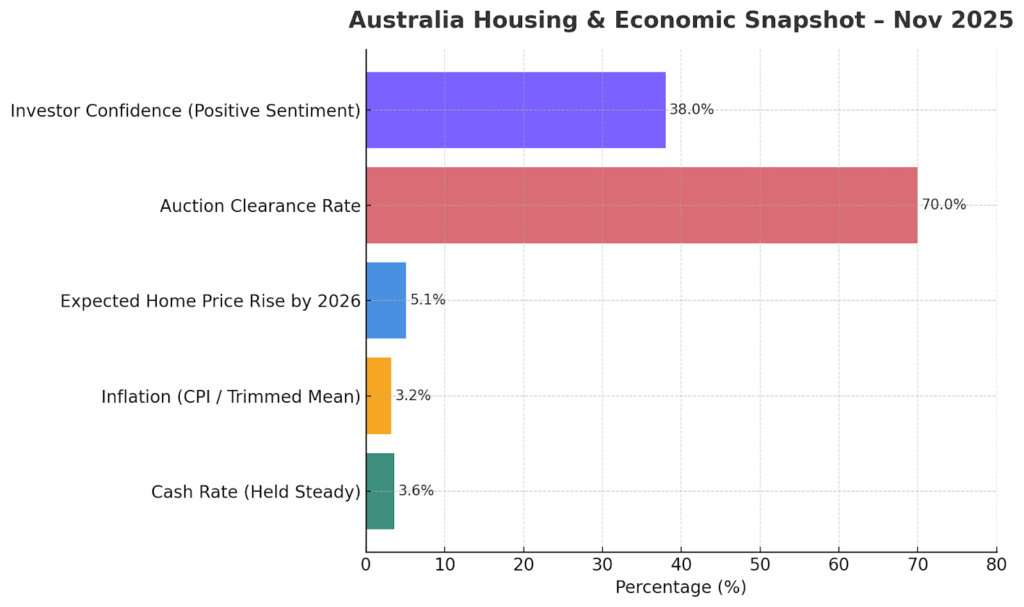

The Reserve Bank of Australia (RBA) held the cash rate at 3.60% in November 2025. Inflation is still above target (3.2% CPI, 3.0% trimmed mean). Economists are projecting that rates will hold at 3.6% through 2026. This effectively creates a stability in borrowing costs right now, for a sense of certainty for purchasers and investors alike.

- Borrowing Ability: Not only will the interest rate remain stable, so will your future home loan repayments and borrowing ability. Lenders will be stress-testing with current rates, so serviceability tests will be linear. It’s a good time to review your loan, consider refinancing or switching to a lower rate before any future rate moves.

- Early Bird Advantage: By the end of 2026, home prices are projected to see a national average increase of 5.1%. Auction clearance rates of approximately 70% demonstrate limited supply and strong demand. As prices are still rising monthly, buyers are likely to pay higher prices (and a bigger deposit) if they wait to purchase.

- Investor Confidence: A steady rate environment is good news for investors. Rental yields remain firm, and vacancies are low. A recent survey shows 38% of Australians think now is a good time to buy. Our brokers can help structure your investment loan to maximise tax benefits.

South Australia’s Stamp Duty Reform Boosts Affordability

Tax policy changes in South Australia add to these opportunities. The SA Liberals have pledged to phase out stamp duty by 2041, starting by removing it for first-home buyers on existing homes up to $1 million. Over 15 years, stamp duty brackets would be gradually cut until the tax is eliminated. This reform would make owning a home more affordable.

- Larger Deposits (or Smaller Borrowings): Getting rid of stamp duty provides massive upfront savings. First home buyers typically pay hundreds of thousands on stamp duty- by not having to pay this levy, you can increase your deposit or reduce the loan. This effectively increases your capacity to borrow.

- More Buyers in the Market: The abolition of stamp duty should create more buyers. It lowers the barrier to entry, and if there are more buyers in the market, they can consolidate prices and increase new housing. Our brokers can provide guidance on how this might impact your loan strategy.

What This Means for You

- Check Your Borrowing Power: With rates now stable and some possible tax savings, your borrowing capacity may be different. OM Financials can calculate it again- you may be eligible for a larger borrowing capacity or receive better loan terms.

- Refinance or Shop Around: Now is a good time to evaluate home loans. Even if you can save a small percentage, it will add up to thousands of dollars.

- Use New Incentives: First-home buyers (especially in SA) should watch for stamp duty changes and any grants. Removing stamp duty can significantly lower upfront costs. Our brokers can help structure your deposit and loan to maximise these benefits.

At OM Financials, we make getting a home loan easy and guide you through each step. You can book a free consultation to connect with our expert advisors today or call us anytime on 0478 876 967.