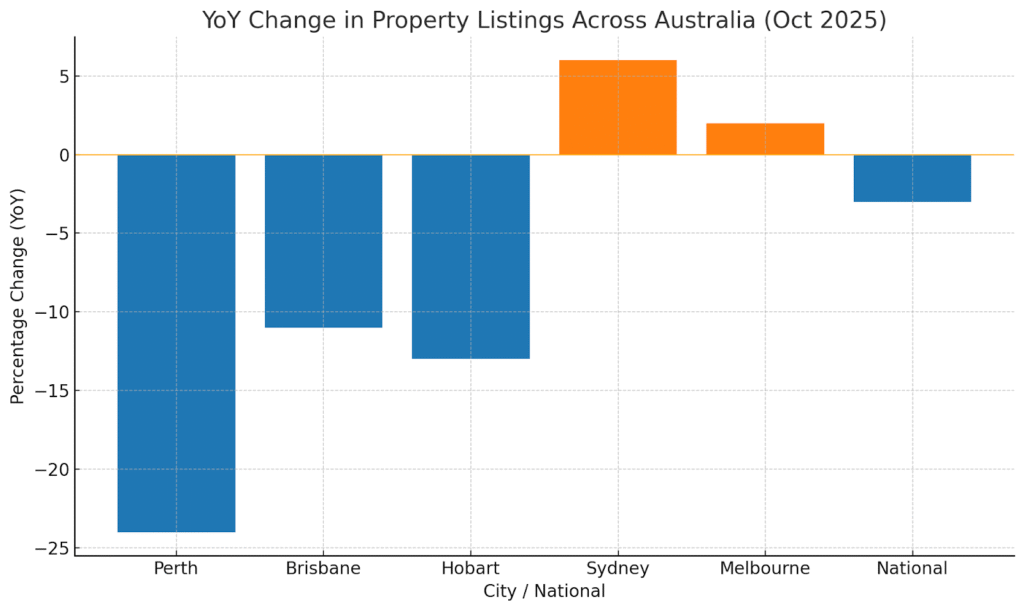

Australia’s property market is in full spring swing – traditionally a busy season for home sales. However, many cities now face unusually low stock. In fact, LJ Hooker’s latest listings report shows that Brisbane’s available homes are down about 23% and Hobart’s down about 32% from normal levels, with Darwin also around 25% below usual levels. According to the latest REA Group Listings Report (October 2025), stock levels are down year-on-year, not long-term averages. The latest figures show:

Perth listings are down –24% YoY

Brisbane listings are down –11% YoY

Hobart listings are down –13% YoY

Sydney listings are up +6% YoY

Melbourne listings are up +2% YoY

National listings down –3% YoY

In short, many areas still have fewer homes for sale than they did this time last year, but the latest November data provides a more accurate picture, showing that things are a bit more balanced than the older “below average” figures suggested.

This shortage of listings is a boon for sellers but a challenge for buyers. With fewer properties for sale in several cities, many homes now attract multiple bidders at auction, and missing out can mean a long wait for the next one. Market analysts note this imbalance between supply and demand is clear: home sales are running above average even as stock remains tight. In practice, that means prices are staying firm and buyers must be very well prepared.

Tips for Buyers You Must Hear

To navigate a tight spring market, consider these strategies:

- Get pre-approved and know your budget. Arrange home loan pre-approval early so you understand your borrowing power and can act instantly when a suitable property appears.

- Prepare for more competition. The federal government’s expanded First Home Loan Deposit Scheme is bringing additional first-time buyers into the market (more homes can be bought with just a 5% deposit). Combine this with lower interest rates, and you’re facing more bidders than usual.

- Expand your search. If there aren’t many listings in your favourite suburb or city, try looking in nearby areas or smaller towns. You can also consider different types of properties — like units instead of houses, or homes that need a bit of work, because they often have more options available.

- Refine your loan strategy with a broker. Refine your loan plan with a broker. A good broker, like us at OM Financials, can help you work out the right deposit and LVR, compare loans from many lenders, and recommend useful features like offset accounts, redraw, or interest-only options. Being loan-ready gives you a real advantage in a competitive market.

In this environment, acting quickly and realistically is crucial. Some sellers are waiting for the highest possible price, so when a good property appears, buyers often need to act quickly. That’s why having professional guidance can make a big difference.At OM Financials, we’re considered reliable for handling difficult loan proceedings as well. We’ll help you find the right approach and walk you through the whole process. If you want guidance and are willing to invest, contact us freely on 0478 876 967 or book a free consultation with us.