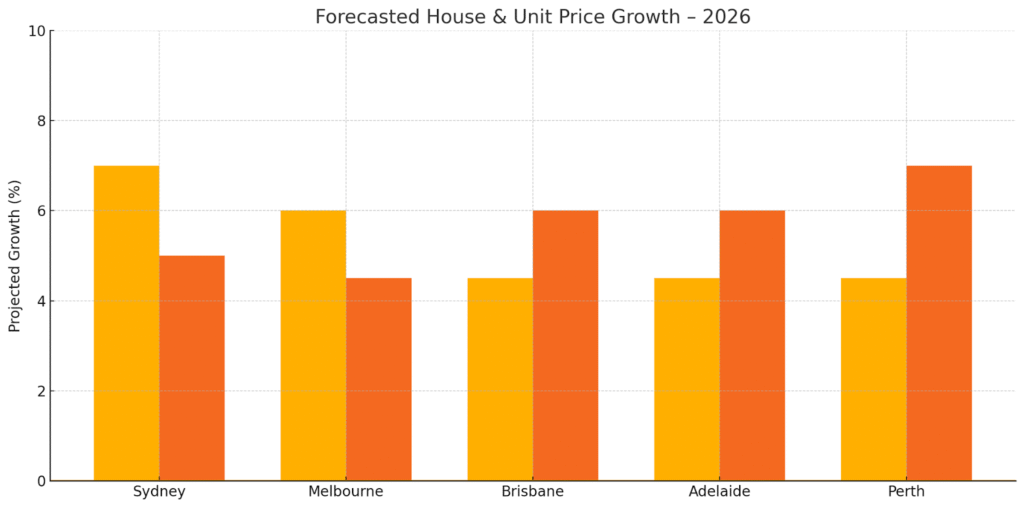

Australia’s housing market is expected to heat up again in 2026. Domain’s latest forecast sees house prices hitting new peaks in every capital city next australianpropertyupdate.com.au. For example, Sydney’s median house price could climb by about 7%, reaching roughly $1.92 million, while Melbourne may rise about 6% to around $1.17 million. Brisbane, Adelaide and Perth are expected to see more modest house growth (around 4–5%). Units are forecast to rise too, especially in tighter markets. Brisbane, Adelaide and Perth units may grow 5–7%, as buyers seek more affordable alternatives. In short, house and unit prices across the combined capitals are likely to lift by around 5 to 6% in 2026.

Several factors are driving this outlook. Interest rates are expected to ease through 2026, making borrowing cheaper and boosting demand. Household incomes are growing, and a flood of first-home buyers is hitting the market under the Federal Government’s expanded Home Guarantee Scheme. Domain estimates the upgraded scheme (allowing a 5% deposit and higher income/price caps) could push prices up by as much as 6–7% in its first year. In effect, the early-2026 surge in buyers is likened to several rate cuts happening at once. As one broker noted, “some buyers are trying to get in before the scheme boosts demand at the lower end of the market”. Meanwhile, Australia’s chronic supply shortage and strong investor interest will also keep prices firm. By end-2026, rents are tipped to hit fresh highs (roughly +3–4% on top of already-high levels), which in turn fuels investor competition.

Impacts for borrowers

For home buyers, the forecast of rising prices has direct implications. Borrowing power will be squeezed as values climb. In practical terms, a given income and deposit will secure a smaller share of a property. Many Australians still hold pre-approvals based on last year’s prices – those old figures won’t stretch as far in today’s market. As OM Financials advisors remind clients, “we match borrowing power to real prices today, not the estimates from 12 months ago”. That means you may need a larger deposit or a higher income than originally approved. In a rising market, it pays to update your pre-approval early – even if you only plan to buy in 2026 – so you know exactly where you stand.

Competition is also intensifying. More first-home buyers can now enter the market with only a 5% deposit under the expanded Home Guarantee Scheme. This is good news for eligible buyers, but it also means stronger bidding wars at the affordable end of the market. If you’re a first-home buyer, expect to compete with others using these incentives. If you’re an upgrader or downsizer, keep in mind that value growth is being driven by these first-home buyers and investors, especially in popular markets. Outer and growth suburbs – where median prices are lower – are likely to see relatively higher growth as buyers chase affordability.

Planning your loan and budget

Given these trends, careful loan strategy and budgeting are key. If prices are set to rise, it pays to have your deposit ready or saved up. In practical terms, this means factoring in that you might need 10–20% more cash than previously estimated for a similar property. Plan ahead and start budgeting now under the assumption that house values will be higher.

You should also think about the loan structure. Interest rates are expected to fall next year, so locking in a portion of your loan at a fixed rate now can protect against any interim rate rises. At the same time, keeping some flexibility (e.g. a variable portion) lets you benefit from rate cuts when they come.

Finally, make sure you have a buffer in your budget for higher mortgage repayments, as well as other expenses (insurance, rates, maintenance). If you’re thinking of an investment loan, remember that rental yields are strong with record-high rents. Higher rents mean rental income is better, but also stiffer competition from other investors. Always run the numbers on cash flow and serviceability.

Moving forward with confidence

To sum up, 2026 is shaping up as a strong year for property prices. For home buyers, this means higher price tags and fierce competition. But with the right preparation, you can still secure your goal home or investment on a solid footing. Get pre-approved now on today’s prices, save diligently for your deposit, and consider speaking to a broker about loan options. At OM Financials, we help borrowers navigate exactly this kind of market. Also, feel free to book your free consultation now or call us anytime at +61 478 876 967. We are always available to help you in the best manner possible.