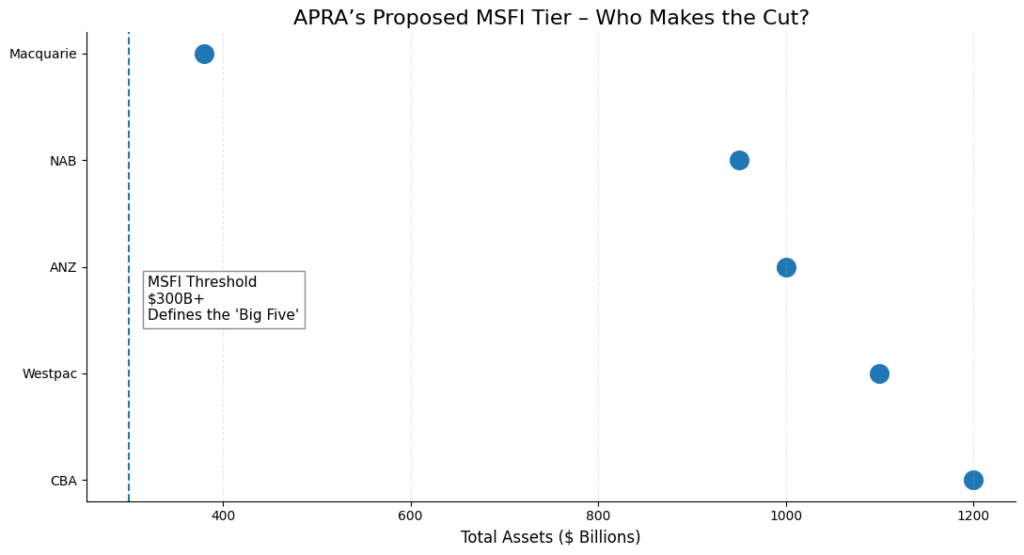

Australia’s prudential regulator (APRA) is consulting on a three-tier banking framework to boost competition. In its December 2025 discussion paper, APRA proposed a top tier of Most Significant Financial Institutions (MSFIs) for banks with more than $300 billion in assets. That list would include the four traditional majors (CBA, Westpac, ANZ, NAB) – and Macquarie Bank. In other words, Macquarie’s size now earns it a seat at the table as a “Big Five” bank. APRA explains this change will bring greater certainty and clarity to banking rules and help drive competition in the industry. By explicitly differentiating the very biggest lenders, regulators can tailor oversight (more scrutiny on the majors, lighter rules for smaller banks) and reduce red tape where possible.

Macquarie joins the “Big Five” by the numbers

Macquarie’s recent growth puts it firmly in major-bank territory. According to APRA’s figures, Macquarie now has roughly $379 billion in total assets (around $316 billion of these are resident assets) and a home-loan book of about $153.7 billion as of October 2025. This equates to roughly 6.4% of the total $2.3 trillion Australian mortgage market. Its lending has been surging – far outpacing other non-majors – and even challenging the Big Four on service speed and customer satisfaction. In short, Macquarie is no longer just an ambitious challenger; by APRA’s new criteria, it is officially a systemic “big bank”.

Clearer rules and more competition

The new three-tier framework is about proportional regulation. APRA says banks in the top tier will face heightened requirements, while smaller lenders get more breathing room. For borrowers, this is mostly good news: a formally recognised fifth major bank means more competition for home loans. APRA explicitly links the reform to increased competition – aiming to “drive competition in the industry” and support growth from smaller banks. Practically, we can expect Macquarie to compete more aggressively on pricing and offers, knowing it’s now in the same regulatory club as CBA/ANZ/NAB/Westpac. In a market where a few large banks dominate 80% of mortgages, adding Macquarie as a full “major” will give borrowers an extra high-grade option. Overall, loans should become a bit more negotiable, and service standards (e.g. turnaround times) are likely to improve as lenders fight to win business.

What this means for brokers and borrowers

- Expanded lender choice. Macquarie is now effectively a fifth major bank to consider. For brokers, this means another strong option on the panel. We can put Macquarie’s products side-by-side with the Big 4 when advising clients, giving borrowers more avenues to secure a loan.

- Sharper rates and offers. Greater competition usually leads to better deals. Expect Macquarie to roll out competitive rates and specials to grow market share. Brokers should compare Macquarie’s interest rates, features and servicing policies directly with those of the incumbent majors.

- Quick approvals. Macquarie has earned a reputation for fast loan turnaround and excellent customer service. This can be a real advantage for time-sensitive clients (e.g. in a hot market where speed matters). We’ll leverage Macquarie’s efficiency for borrowers who need a fast settlement.

- Regulatory strength. APRA’s move officially brings Macquarie “inside the tent”. In practice, it means Macquarie will face the same strict oversight as the other majors. Clients can be reassured that Macquarie is treated as a core part of the banking system – its stability is backed by APRA. In short, Macquarie’s designation as an MSFI underscores its strength, not weakness.

- Broker guidance. Now more than ever, borrowers need a broker to sort through options. We help navigate the expanded landscape – majors and challengers alike – to pick the right lender for each scenario. Whether a client wants the widest choice, the fastest approval, or the most competitive deal, our expertise ensures their loans are structured to suit their goals.

How OM Financials can help

At OM Financials, our mortgage brokers stay on top of these changes so you don’t have to. We’ll explain what Macquarie’s new status means for your borrowing power and compare loans from all five major banks (and beyond). Whether you’re a first-home buyer, upscaler or investor, we make the loan process simple and tailored to your needs. Speak with our brokers today to understand your options in this evolving market. Book a free consultation or call us anytime at +61 478 876 967.Follow us on Instagram and LinkedIn for the latest mortgage and property news.