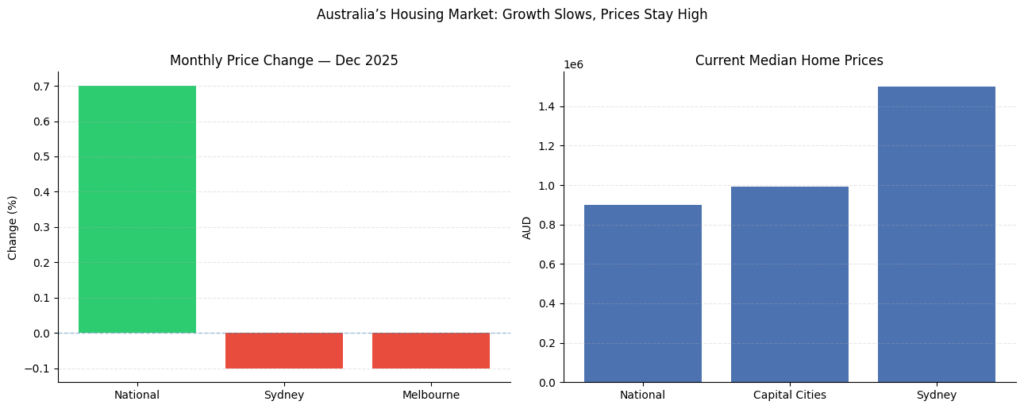

Recent data show Australia’s housing boom is easing. National home values rose just 0.7% in December – the smallest monthly gain in five months. In fact, both Sydney and Melbourne saw prices fall by about 0.1% in December, the first dip in those markets since early 2025. Despite this slowdown, 2025 was still a strong year: home values jumped about 8.6% for the year, adding roughly $71,400 to the national median home price.

The current median home price in Australia is around $901,000. In our big cities, it’s even higher – the combined capital-city median is about $991,331. Sydney alone is around $1.5 million. These record-high prices mean borrowing power is under pressure. Add to that the uncertainty around interest rates (many economists now expect rates to stay higher for longer), and it’s clear buyers need to plan carefully.

What This Means for Borrowers

- Strong demand under $1M: Government schemes are pushing the entry-level market. The 5% deposit scheme for first-home buyers is fueling growth in homes priced under ~$1M abc.net.au. If your budget is in this range, expect keen competition – more buyers can get in with a small deposit. That scheme creates opportunities, but remember that lenders still apply strict serviceability checks. You’ll need to meet the deposit and income requirements even with the scheme.

- Caution in Sydney & Melbourne: These cities just saw a rare price dip, reflecting growing affordability constraints. With Sydney’s median near $1.5M, fewer buyers can afford to borrow that much. If you’re buying or renewing a loan here, be very realistic about repayments. Even a small interest rate rise can add hundreds of dollars each month. It’s wise to build an extra buffer into your budget.

- Opportunities in other capitals: By contrast, some markets remain strong and more affordable. In December, Adelaide and Perth prices rose by ~1.9%, and Darwin and Brisbane by ~1.6%. These cities have lower median prices and still-growing demand. Your borrowing power goes further in these markets – and they benefit from the same low-deposit scheme for first-home buyers. We’re seeing smart buyers looking at Perth, Adelaide and SE Queensland, where they can buy more house for their money.

- Tighter credit rules: The banking regulator is also stepping in. From Feb 2026, APRA will cap the amount of very-high-debt lending banks can do. In practice, only 20% of new loans can have borrowers with debt above 6× their income. This means lenders will scrutinise incomes and expenses more closely.

- Refinancing and loan review: Many Australians have built solid equity in 2025 thanks to rising prices. Now is a great time to revisit your loan. Could you refinance to a lower rate or a better product?

Every borrower’s situation is unique. These trends mean loan structuring and advice are more important than ever.

OM Financials is ready to help you understand any changes that may affect your financial situation. The mortgage brokers at OM Financials monitor the mortgage market and government policy changes on an ongoing basis. To discuss your borrowing capacity and other options, please contact us for a free consultation or call 0478 876 967 and follow us on LinkedIn and Instagram. OM Financials will help you take steps to move forward with confidence.