RBA Deputy Governor Rules Out Near-term Rate Cuts

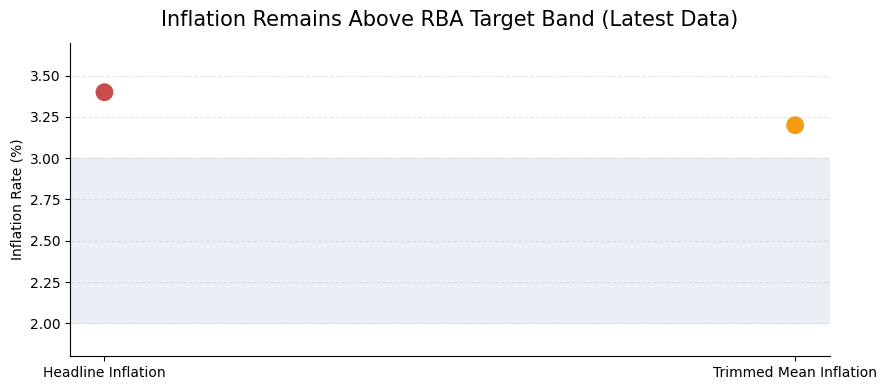

In January 2026, the Reserve Bank of Australia (RBA) signalled that any quick turnaround on interest rates is off the table. In an ABC interview, Deputy Governor Andrew Hauser warned that hopes of cutting the cash rate soon have been “all but extinguished”. He noted that even though inflation is easing, prices are still rising at about 3–3.4% year-on-year, above the RBA’s 2–3% target range. In fact, trimmed-mean inflation (which strips out volatile items) was 3.2% in November 2025. Hauser stressed that “inflation above 3%… is too high, so the Bank’s priority remains getting inflation back on target. For now, the cash rate stands at 3.6% (held since July 2025), and markets expect it to remain on hold at the next RBA meeting.

Source

- Inflation still above target: Annual CPI was 3.4% to Nov 2025 (trimmed mean 3.2%). This slight easing (from 3.8% in Oct) still sits above the RBA’s 2–3% goal. The RBA has warned that keeping inflation down is its top priority.

- Rate cuts off the table: With inflation running hot, Hauser said the chance of cutting rates in the near term is “very low”. In other words, borrowers shouldn’t count on any rate relief at the upcoming February meeting.

- Cash rate on hold: The RBA has kept its cash rate at 3.6% since July 2025. The December 2025 meeting was a pause, and officials emphasised it’s too early to ease. They’ll give more weight to the December-quarter inflation data (due late Jan) before deciding on any future move.

What this means for borrowers

The upshot is that mortgage borrowers should prepare for higher rates to stick around longer. Here are some key takeaways:

- Budget for steady rates: If you have been reading about the possibility of further cuts to interest rates and how it may affect your finances, you should be budgeting today as if we are at the same interest rate level we are now. With interest rates remaining relatively high and repayments being our only option, ensure that you budget for these repayments and have a little extra in case interest rates rise again.

- Consider fixing some of your loan: Many homeowners are already locking in part of their loan to fixed rates for stability. As OM Financials notes, borrowers are “switching from variable to longer fixed rates” because cuts seem unlikely. A split loan (part fixed, part variable) can give you certainty while still allowing some flexibility if rates eventually fall.

- Update your borrowing power: Rising prices and high rates squeeze your buying power. If you have a pre-approval from last year, it may not stretch as far today. As OM Financials advises, “we match borrowing power to real prices today, not the estimates from 12 months ago.

How OM Financials can help

OM Financials understand that this can be very disconcerting news for borrowers. Our experienced mortgage brokers continue to monitor changes in legislation and regulations. We compare mortgage options from over 50 lenders to find the most suitable mortgage for you. We simplify the process and provide you with expert guidance throughout the entire process. Speak with one of our experienced brokers today to determine your borrowing capacity and confidently proceed with your home purchase or refinancing.Feel free to book a free consultation online or call us anytime on +61 478 876 967. Our friendly team can explain the latest mortgage strategies and help you plan for whatever the RBA does next. Also, don’t forget to follow us on Instagram and LinkedIn to stay updated.