In 2025, buying a second property in the Australian property market using equity, without saving a fresh deposit, is not merely a wise concept. Using built-up equity to buy your second property can significantly accelerate your property investment journey, eliminating the need to save a fresh deposit while enabling timely entry into the investment market. By carefully managing Loan-to-Value Ratio (LVR), avoiding unnecessary Lenders’ Mortgage Insurance (LMI), and structuring loans quite responsibly, particularly through cash-out refinance, you can grow your portfolio without incurring excessive cost or risk.

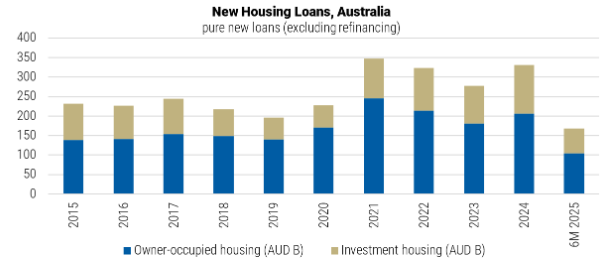

With the current surge in investor lending and favorable conditions, now may be an ideal time to leverage your home equity to secure a second investment property. At OM Financials we regularly help individuals leverage home equity to expand their property portfolio, especially in growth corridors—whether for first-time buyers, homeowners, or seasoned property investors.

What Is Equity, and How Does It Work?

In simple terms, equity is the disparity between the current value of your property and the amount owed on the mortgage. If your home has appreciated since purchase, that value increase becomes equity, the portion you own outright. By refinancing or doing a “cash-out refinance,” you can borrow against that equity, convert it into cash, and use it as a deposit for a second property (or any purpose). This approach lets you unlock the latent value in your home without waiting years to save up cash.

For instance, if your house is now worth AUD 800,000, and you owe AUD 500,000, that leaves AUD 300,000 in equity. Lenders might allow you on certain conditions to tap up to 80% of the property value, so potentially up to AUD 640,000 meaning you could release AUD 140,000 of usable equity (after accounting for the owed amount).

Loan-to-Value Ratio (LVR) and What Lenders Look For

Lenders assess how much they are willing to lend based on the LVR, the loan amount divided by the current property value. A lower LVR signals that you hold more equity and therefore represents lower risk for lenders. Typically:

- An LVR of 80% or less is considered safe, & you will usually avoid extra costs.

- If LVR exceeds 80%, many lenders require the borrower to pay LMI, a one-time insurance premium that strictly protects the lender in case of default.

- LMI is usually added to your loan amount if required, increasing your overall debt and the interest you will pay over time.

Therefore, when you use equity to fund a second property, aim to refinance up to a maximum LVR at or below 80%. That ensures you minimize risk and reduce LMI, which helps in saving/minimizing upfront cost and long-term loan burden.

Avoiding Unnecessary LMI Smart Financing Strategies

Because LMI is triggered when LVR exceeds 80%, it’s critical to structure your refinance carefully. Here are some strategies to avoid LMI:

- Strictly ensure at least 20% equity in the property before refinancing. This puts your LVR at 80% or below.

- Structure the loan carefully: include only what is needed (deposit + costs), & avoid capitalizing on unnecessary costs to inflate the loan size.

- Take advantage of lenders or loan products offering higher LVR thresholds without LMI (some lenders may offer up to 85% LVR No-LMI under certain conditions).

- Leverage value-add improvements for instance, renovations can raise your property’s value quite significantly, increasing equity (thus lowering LVR) without increasing your loan.

- Use a guarantor or additional security if needed; sometimes family-backed or dual-income guarantees can help unexpectedly to avoid LMI or secure better LVR terms.

By applying such exceptional strategies, you unlock equity responsibly and avoid the hidden costs associated with LMI, making your second property purchase much more financially efficient.

Cash-Out Refinance for Investment: What You Should Know

Cash-out refinance is the process of replacing your existing mortgage with a new one for a larger amount and taking the difference in cash. That cash then becomes your “deposit” for your second (investment) property.

Key points for using cash-out refinance for investment:

- It converts equity into investable funds; there is no need to save a fresh deposit.

- Since your original home serves as collateral, the LVR for the refinance should remain within acceptable limits to satisfy the lender.

- Once the refinance is primarily approved, the cash-out amount can be widely used for acquisition of the second property, such as immediate settlement or deposit.

- The new loan will likely have different repayments or interest terms, so factoring in serviceability (your income vs. obligations) is critical.

Using equity to acquire a second investment property remains attractive, especially in a market environment with rising property values & relatively low occupancy rates.

How OM Financials Approaches Equity-Based Second Property Financing

At OM Financials, we basically prioritize safety, structure, and long-term strategy while helping clients leverage equity to invest. Here’s how we approach it:

- We certainly begin with a detailed appraisal of your existing home to establish the realizable equity according to the existing market situation.

- We then assess your overall borrowing capacity, factoring in income, existing debt, potential rental income, and, above all, serviceability of multiple loans, making certain you don’t overextend in any way.

- We structure a refinance or cash-out plan that keeps LVR at or below 80% to help you avoid unnecessary LMI and structure loans so that you remain serviceable even after acquiring multiple properties.

- We therefore ensure full compliance with lender underwriting standards, especially for investment-purpose loans, and guide you through documentation, approvals, etc.

Final Thoughts

Using equity release orcash-out refinance to fund your second property can be a quite smart, efficient way to expand your investment portfolio without waiting years to save a new deposit. Therefore, with the right planning, risk management, and even professional support from OM Financials, your trusted mortgage partner, this path can deliver real growth and financial stability. If you’re exploring home loans in growth corridors or Schofields, now might be the right time to act.Call now at+61-478-876-967 tobook your free consultation call, or follow OM Financials on LinkedIn& Instagram for expert property insights, market trends, and real success stories of long-term wealth creation.