In 2025’s Australian real estate market, it is imperative to reassess your home loan before 2026; this is not just a wise decision but a necessity. As we are approaching 2026, it is critical for borrowers, investors, and prospective homeowners to step back and review their home loan status and strategy. Whether you are applying for a new mortgage, refinancing, or planning a construction or land purchase, careful planning helps ensure you remain within realistic borrowing capacity, even as rates, regulations, and property prices shift. That’s where OM Financials steps in at this juncture to help you to plan practically, borrow wisely, and grow confidently. Therefore, with rising property values, shifting interest rates, tighter lending standards, and evolving needs, you need both clarity and expertise.

2025: Interest Rate and Mortgage Market Recap

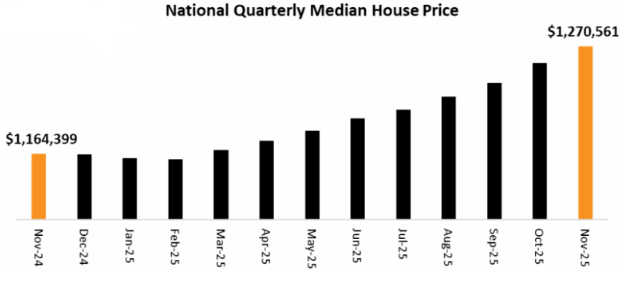

Understanding where the market stands now is the first step to planning for 2026.

- As of mid-2025, the average home loan amount for new owner-occupiers in Australia was close to AUD $678,011.

- The average monthly repayment for this loan amount, mainly based on a 30-year term, was around AUD $3,961 each month.

- Average interest rates for owner-occupied loans (principal & interest) in early 2025 ranged around 6.24% p.a., having standard variable and fixed rates for many borrowers falling in the mid-to-high 5%–6% range, depending on lender, LVR, and loan type.

Why You Should Review Your Home Loan in 2026

Reviewing your mortgage quite ahead of the upcoming year isn’t just good practice; it could help you optimize borrowing capacity, reduce costs, and align finances too with your property goals. Key reasons include:

- Changing interest rate environment: Since average rates remain elevated relative to pre-2022 levels, reviewing your loan strictly ensures you are on competitive terms before further rate shifts or lender policy changes.

- Refinancing potential: Many individuals may benefit from refinancing in 2026 if better rates or packages are available; transitioning could lead to reduced repayments or free up equity.

- Diverse financing needs: Borrowers often pursue financing for unconventional properties, such as land loans (e.g., acreage), house and land packages, new builds, or construction loans. Since the financial requirements and risks for these projects vary quite significantly, it is vital to ensure the loan structure suits your project.

- Borrowing capacity reset: Reviewing your borrowing capacity in 2026 facilitates alignment with updated income, living expenses, and interest costs, ensuring you avoid overextending when acquiring or developing.

2026 Home Loan Review Checklist—What to Evaluate

- Borrowing capacity 2026: With interest rates settling but still elevated, your borrowing capacity may not be what it was in pre-2022 times. Use up-to-date income together with deposit & expense information mainly to get a realistic sense of what you could borrow.

- Mortgage 2026 planning: Re-evaluate whether your current mortgage structure (fixed vs. variable, interest-only vs. P&I, loan term) still fits your income trajectory and lifestyle plans.

- Refinancing 2026: Given competitive lender offers, many individuals are refinancing to lock in better rates or restructure loans. Around 33,000 Australians switch their home loan lender every month.

- Purpose-specific loans for land, construction, and packages: If you plan to invest in a lifestyle acreage at Annangrove, a house-and-land package in Nirimba Fields, or a new build in Beaumont Hills or Gables Box Hill, make sure your loan type matches your needs. Land loans, construction loans, and package financing often have different criteria and terms than standard home loans.

- Long-term cash flow & servicing ability: Even if rates remain stable or fall slightly, property prices have surged recently, so higher loan amounts mean bigger repayments. Understanding long-term servicing capacity is critical.

How OM Financials Helps You Plan Practically & Strategically

When you engage with OM Financials, we don’t just look at the numbers; we specifically consider your entire property journey. That means:

- Evaluating your borrowing capacity in 2026 must be based on realistic income, expenses, and market conditions.

- Advising on the best loan structure (fixed vs. variable, interest-only vs. principal and interest) to maximize flexibility and minimize long-term cost.

- Guiding you through finance options tailored to specific aims, whether it’s land loans (e.g., acreage at Annangrove), house-and-land packages (like in Nirimba Fields), construction loans (such as Gables Box Hill), or new build finance (e.g., Beaumont Hills).

- Recommending whether refinancing in 2026 makes sense for you, especially given the highly competitive market and growing lender options.

- Helping you anticipate future rate changes and housing market shifts—making sure your loan sustainability stays intact even in uncertain times.

These informative strategies strongly ensure that as a home buyer, investor, or homeowner, your home loans are truly aligned with your long-term property goals, cash flow needs, and financial well-being.

What to Do Next: Your 2026 Home Loan Action Plan

- List your current loans (if any), interest rates, repayment structure, and outstanding term.

- Project your expected income and expenses for the next 2–3 years, including any life changes (job change, kids, relocations, renovations).

- If you are considering a new property—whether acreage, a house-and-land package, a new build, or construction—gather all relevant details (location, deposit, build schedule, and expected repayments).

- Reach out to a qualified mortgage broker (like OM Financials) for a full borrowing capacity assessment and loan structure advice.

- If refinancing seems quite beneficial, compare current lender offers, fees, and the long-term repayment impact, rather than solely pursuing the lowest rate.

Final Thoughts

Reviewing your home loan ahead of 2026 isn’t just about checking boxes; it’s certainly about planning practically. With 2025 showing high average loan sizes, elevated interest rates, and, above all, robust refinancing activity, borrowers who act now have a better chance of locking in favorable terms and aligning their finances with long-term property goals.Whether you’re buying land, building from scratch, refinancing, or investing, a thorough loan review greatly helps secure your financial future. Call now at+61-478-876-967 to book your free consultation call, or follow us on LinkedIn & Instagram for more information, expert property advice, market trends, and insights for long-term growth and wealth creation.