The Double Squeeze: Rising Rents and Home Prices in 2026

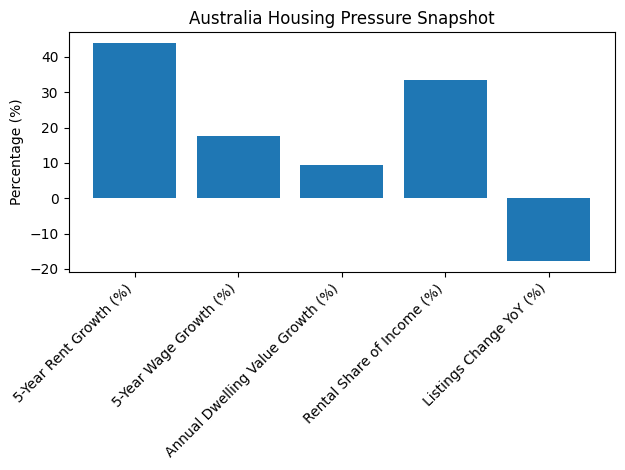

Recent data show rents and house prices are climbing across Australia, a double squeeze on borrowers. National rents have soared 43.9% over the past five years, while wages rose only 17.5%. This means renters now spend a record 33.4% of their income on rent. Western Australia is especially hard hit, WA rents jumped about 66% in five years, pushing more households into tight budgets. Rents continue rising, about 5.4% year-on-year to January 2026.

Meanwhile, demand for homes keeps values up. National dwelling values are 9.4% higher over the last year, adding roughly $78,699 to the median home price. Home sales are brisk (up about 4.1% year-on-year) even though advertised listings remain very low. In fact, total stock for sale is 17.8% below last year’s level. With fewer homes listed and many buyers competing, prices are holding up – Australia’s total housing market value hit about $12.4 trillion.

Key statistics:

- Rent vs Income: Rents +43.9% (5 yrs); wages +17.5%

- Rent share of income: Record 33.4% of household income to rent

- Western Australia: Rents +66% (5 yrs)

- Annual rent growth: 5.4% (to Jan 2026)

- Home values: +9.4% annual; median +$78,699

- Home sales: +4.1% yearly

- Listings: Inventory –17.8% vs last year

- Total market size: $12.4 trillion

What this means for borrowers

Sharp rent increases squeeze budgets. Higher rents leave tenants with less spare cash for savings or loan repayments. Many households (especially renters) have a tighter borrowing capacity because more of their pay is locked into rent. It also means saving for a deposit is harder, so first-home buyers face longer saving times or need more help. At OM Financials, we see clients asking how to balance rising living costs with loan payments; it’s a common stress.

Rising home prices mean bigger loan sizes. With a nearly 10% jump in values, buyers need larger loans just to keep pace. Lenders will scrutinise your serviceability closely – especially debt-to-income ratios and living expenses. In this climate, having clear evidence of income and buffers is important. It can help to prepare a cash-flow buffer (savings set aside) in case costs rise further.

Investors must weigh yields against higher purchase costs. As prices climb, rental yields can shrink unless rents keep up. With rents up strongly but not at the same rate as values, yield pressure is rising. Brokers may advise investors to look in regional areas or smaller capitals where rent growth is very strong (e.g. regional WA rents jumped 10.1% recently). Every market is different – for example, the ACT saw rent and wage growth more in line, easing stress there, while WA’s rent surge is far outpacing income.

Implications at a glance:

- Saving challenges: First-home buyers may need help (e.g. guarantors, deposit bonds) as saving is harder.

- Regional vs city: Some states (WA) and regions face greater rent rises than others (ACT), so local market knowledge matters.

- Early action: In tight markets, a mortgage pre-approval is essential. It strengthens your offer and lets you move quickly on a property.

How OM Financials can help

At OM Financial Services, our brokers know these trends well and can guide you through them. If you’re wondering how much you can borrow with higher rents and prices, talk to us early. We can help you explore strategies—from different deposit/LVR options to budget management – so you borrow wisely. For example, our first home loans advice can show first-timers how to plan with limited savings, and our home loan pre-approval service lets you shop confidently in this fast market.Speak with our experienced brokers today to understand your borrowing power and loan options in the current market. We’ll compare offers from 50+ lenders and explain steps in simple terms. Book a free consultation now or give us a call – we’re here to make the loan process simple. Contact OM Financials anytime at 0478 876 967 or book a free consultation. Don’t forget to follow us on LinkedIn and Instagram as well.