As the financial landscape evolves, 2025 has been a year of significant shifts in mortgage borrowing capacity across Australia. With shifting interest rates, changing lending patterns, & regulatory adjustments, many prospective homeowners, investors, and construction-loan seekers saw their borrowing capacity fluctuate to some extent, sometimes substantially. With property prices still high and loan sizes reaching record levels, understanding borrowing capacity in 2025 is more critical than ever. For buyers in areas like Kellyville Ridge and North Kellyville seeking first home loans, construction loans for new builds, or refinance home loans in Kellyville Ridge, understanding these changes is key to “planning practically” for 2026. At OM Financials, we believe financial clarity matters. In this blog, we will sincerely review what changed in 2025, provide data-driven insight, and outline what those changes could mean for 2026.

What Changed in 2025: Interest Rates, Market Behavior & Lending Trends

- Interest Rate Reductions Breathe Life into Borrowing

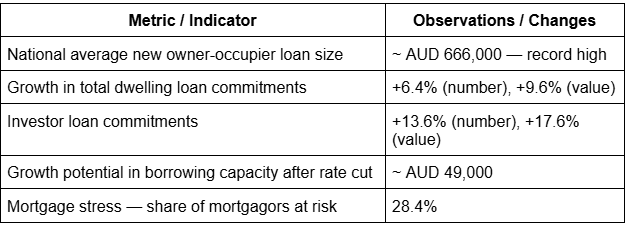

In the beginning of 2025, the Reserve Bank of Australia (RBA) reduced the cash rate dramatically from 4.35% to 3.60%, prompting many lenders to lower their variable mortgage rates accordingly. As a consequence, scheduled mortgage payments for many households eased slightly, though overall debt service levels remain among the highest since 2012.

Consequently, borrowing capacity improved for many, particularly dual-income households. According to modeling from a leading property data firm, a 25-basis-point rate cut could increase borrowing power by up to A$49,000 for eligible households.

- Loan Sizes Reach Record Highs Despite Cautious Buyer Sentiment

Despite earlier caution due to elevated rates, average mortgage sizes surged. New owner-occupier home loans across Australia climbed to record highs; average new home loans reached approximately A$666,000 in late 2024/early 2025.

This trend underlines a paradox: rates dropped and borrowing capacity expanded, but home prices and loan sizes remained high, reflecting ongoing demand and limited affordability.

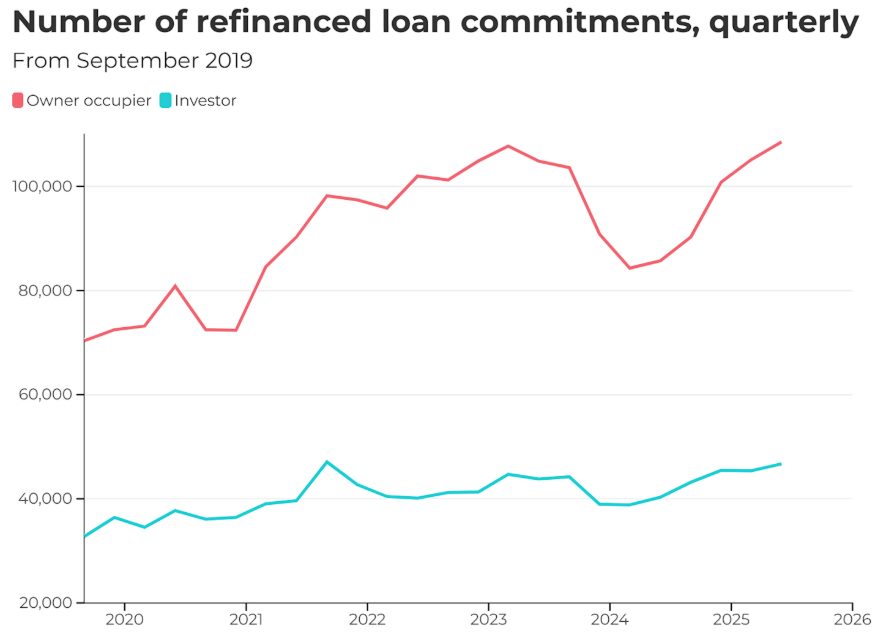

- Lending Trends: More Refinancing; Investor Loans Surge; First-Home Borrowers Struggle

- According to recent data from the Australian Bureau of Statistics (ABS), in the September quarter of 2025, the number of new home loan commitments rose by 6.4%, and the value of those commitments increased by 9.6%. Owner-occupier loans rose by 2.0% in number and 4.7% in value. Investor loans rose even more sharply, 13.6% in number and 17.6% in value.

- Meanwhile, the average size of new owner-occupier home loans nationally hit a record of A$666,000.

- In 2025, the growth among first-home buyer (FHB) loans remained flat at around 123,363, while non-FHB loans grew by 9% annually.

- Furthermore, first home buyers typically borrowed less than other borrowers: the average FHB loan size is about A$546,315, which is roughly 22% less than the non-FHB average of A$700,171.

Together these conditions show borrowing capacity in 2025 was under pressure—rising home prices drove bigger loans for many, but first-time buyers faced constraints in some manner.

What These Changes Mean for 2026: Planning Your Home Loan Strategy

For 2026, the shifts in 2025 carry a few clear implications.

- Borrowing capacity will always remain elevated, but discretion is the one & only key. Lower rates and rising loan limits may allow borrowers to access higher-value mortgages, whether for first homes, new builds, or refinancing. Still, larger debts increase long-term financial burden, especially if living costs or interest rates rise.

- Investor demand is accelerating; new builds and construction loans will remain popular. The jump in investor lending and value of loans suggests strong investor confidence, especially in growth corridors and new-build markets. For those considering construction loans (e.g., new builds in suburbs like Kellyville Ridge), these rates could remain attractive.

- First-home buyers need sound support and advisory guidance. Given rising loan sizes and complex market conditions, first-time buyers must rely on experienced mortgage brokers like OM Financials to understand true borrowing capacity and make well-informed decisions.

- Refinancing remains relevant, especially for debt consolidation or better rates. Since interest rates remain quite low, homeowners may consider refinancing their existing loans to reduce repayments or consolidate existing debts.

Looking Ahead: What Borrowers Should Do in 2026

- Plan practically—don’t just chase the maximum borrowing limit. Use borrowing capacity as a guide, not a goal. Bigger loans come with bigger responsibilities.

- Consider all loan options. For new builds, a construction loan might be better than a standard home loan; for existing homeowners, refinancing might reduce repayments or free up equity.

- Seek expert brokerage support (like OM Financials). The market and regulations are shifting; good advice matters more than ever.

- Assess your long-term financial sustainability. Factor in potential interest rate changes together with cost-of-living increases and long-term repayment capacity, not just immediate borrowing power.

What Borrowing Capacity 2025 Means for First Home Buyers & Refinancers in 2026

For first-home buyers eyeing suburbs including Kellyville Ridge or North Kellyville, 2025’s record loan sizes and competitive investor pressure mean 2026 might not bring easier buying conditions. Instead, careful budgeting, realistic expectations, and, above all, early engagement with a mortgage broker become quite essential.

For existing homeowners, especially those with sizable home loans from 2025–2026, this period could present an extraordinary opportunity to refinance, restructure, or review loan serviceability in light of income changes or interest-rate shifts.

Final Thoughts: What Lies Ahead in 2026

2025 has been quite a mixed year, where interest rate relief boosted borrowing capacity, but high property prices & rising investor demand limited the benefit for many, especially first-time buyers. As we move into 2026, those hoping to secure a first home or new build or refinance and restructure existing debt must “plan practically.” Yet the competitive landscape, especially in sought-after areas such as Kellyville Ridge and North Kellyville, means timing, preparation, and expert advice will be more important than ever.Call now at+61-478-876-967 to book your free consultation callwith OM Financials , or follow us on LinkedIn & Instagram for expert property advice and explore how much you can realistically borrow and secure the right home loan for your needs. That’s how you turn today’s uncertainty into 2026 success.