The NSW government has launched an AI planning tender to speed up approvals for new housing. Ministers say it will “blitz the approvals backlog” of roughly 26,000 homes currently stuck in environmental assessments, letting builders focus on construction instead of paperwork. Housing Minister Clare O’Neil even put it bluntly: “It’s too hard to build a home in this country… we want builders on site, not filling in forms”.

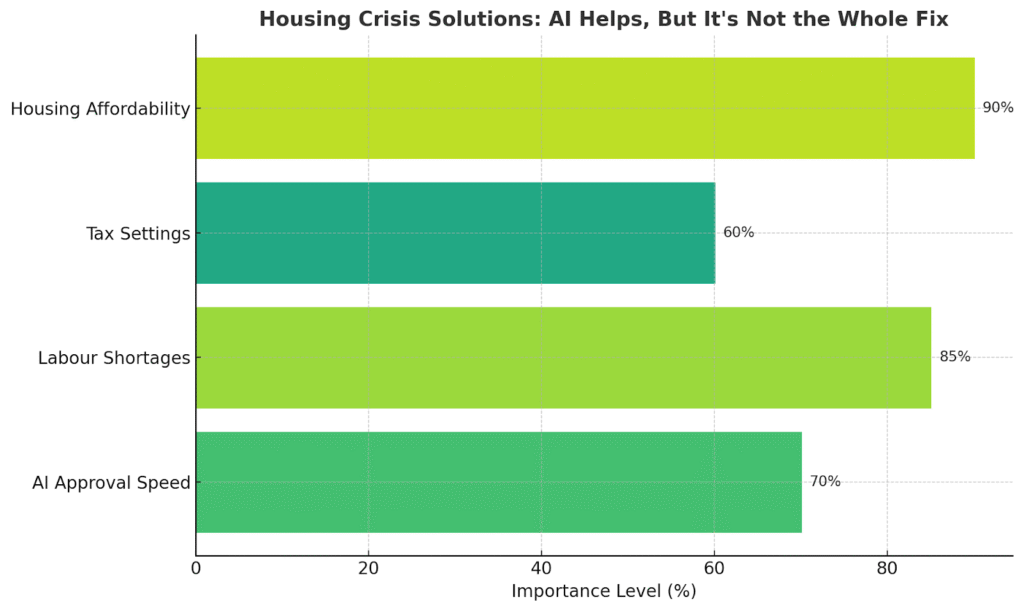

But as brokers, we know that cutting red tape is only part of the story. Automations can definitely help in processing applications faster, but they cannot solve deeper problems. Experts already said that focusing too much on AI can distract from bigger issues like labour shortages, tax settings and overall affordability. In fact, past failures like the Robodebt scheme – an automated debt-recovery system – serve as a cautionary tale: it became a “A$4.7bn fiasco” when too much was entrusted to an automated process without proper safeguards. In the same way, speeding up approvals is welcome, but planning still requires expert judgment to avoid unintended consequences.

What this means for borrowers and investors

Approval delays and supply constraints usually translate into higher house prices. When approvals are delayed, fewer homes hit the market, and prices keep rising. At the moment, large projects take around eight months or more to get government approval. Clearing the backlog will help supply over time, but for now, buyers are facing a tighter market.

Key Points You Can’t Ignore

- Tighter supply and price pressure: A very limited number of places are available to buy or rent with 26,000 homes stuck in the backlog. Prices always rise when the supply is low, but demand keeps increasing.

- Impact on borrowing power: When prices go up, banks may ask for bigger deposits or change LVR limits. With fewer homes for sale, competition grows to make loan serviceability and LVR more important.

- Don’t rely on policy fixes alone: New tech may speed approvals, but structural factors remain. Labour shortages and the tax/finance settings that affect building and buying will take longer to fix. Homebuyers and investors shouldn’t wait on AI or new grants as a guaranteed cure. You’ll likely still need a solid deposit and a flexible loan plan given the current market constraints.

- Plan with a broker: This is where mortgage brokers help. In today’s uncertain market, we explain your options, compare fixed and variable rates, and match you with the right lender.

Smart Finance Moves When Housing Competition is Fierce

At OM Financials, we keep close tabs on these housing policy changes and market trends. Our role is to guide you through the complexity. Right now, that means helping you secure the strongest finance package possible given supply-side pressures. Whether you’re a first-home buyer needing a fast pre-approval or an investor looking to maximise borrowing, we can crunch the numbers for your scenario. A broker’s expertise can make all the difference when homes are scarce and competition is high.Want to proceed? OM Financials can help you explore your loan options from deposit and LVR strategies, so you can move forward confidently. Speak with our brokers today to understand your borrowing power and options available. You can also contact us on 0478 876 967