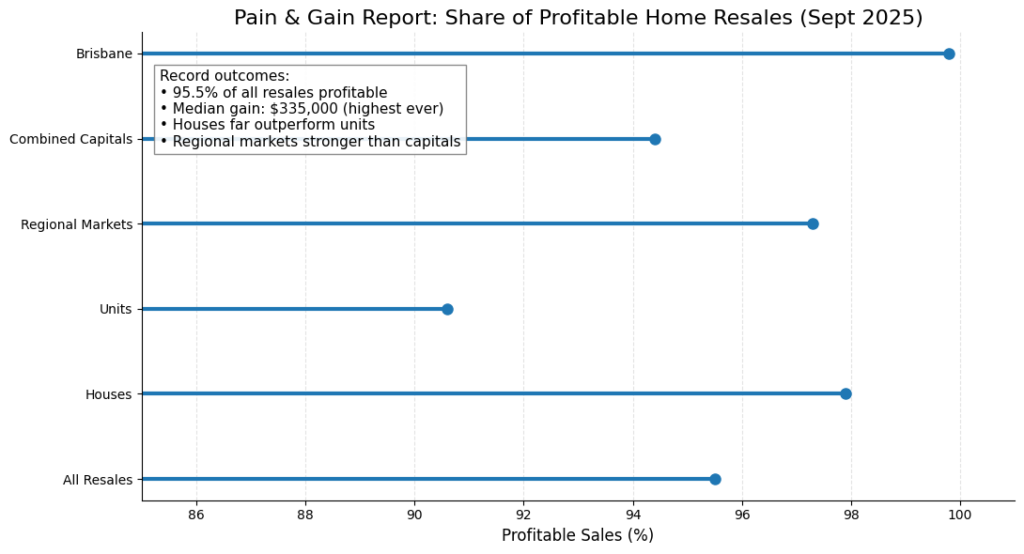

Australia’s latest Pain & Gain report (Sept 2025) shows home sellers made record profits. In Q3 2025, 95.5% of resales returned a profit – the highest level since 2005. The median gain was a record $335,000. This surge comes as national home prices hit new highs for months, helped by easier credit conditions after the RBA cut rates earlier in the year. (In short, most long-term homeowners have gained big equity.)

- Key stats: 95.5% of homes sold for a profit in Sept 2025 (up from 94.9% in June). Median seller gain was $335,000 (a new record). Houses outperformed units – about 97.9% of house resales were profitable vs 90.6% of units. In capitals, Brisbane led with 99.8% profit rate (median gain $444k), while Darwin and Melbourne saw higher loss rates. Regional markets stayed stronger: 97.3% of regional resales made a profit, versus 94.4% in the combined capitals.

Key Considerations for Borrowers

These trends create both opportunities and risks for borrowers:

- Tap into your equity: With a rise in property prices in Australia, many homeowners are now able to take advantage of this increase in value and access additional equity. You might want to consider refinancing your existing home loan so that you can access this equity and use it for renovations or to make an investment. Refinancing can also provide you with the opportunity to obtain a lower interest rate or better product features.

- Review your loan structure: Now is a good time to check if your loan type fits your plans. If rates worry you, you might fix part of your loan and keep some variable. If you’re on interest-only, plan when to switch to principal-and-interest. A balanced loan mix can protect you whether rates rise or fall.

- Prepare for higher rates: The outlook for 2026 is less certain. Recent buyers (who bought near the peak) should allow a buffer for rising repayments. Make sure your budget and pre-approval match today’s higher prices. If you approved a loan months ago, update it now. Always have savings for rate rises or unexpected costs.

- House vs unit & location risks: Houses have largely held value (97.9% profit rate), while units lagged. If you own or plan to buy a unit, be cautious with high leverage. Also, note that regional markets did better than big cities. Stronger markets like Brisbane and Adelaide saw almost all sellers’ profit. If you’re in an expensive metro market (Sydney/Melbourne), watch out for segments where prices are flattening.

At OM Financials, we’re here to help you navigate these market shifts. Our team will work with you through each aspect of the loan comparison process between over 50 lenders and ensure that you are aware of your options for leveraging equity in your home or protecting your loan from any rate fluctuations.Contact us today to schedule a free consultation with one of our experienced brokers by calling +61 478 876 967. During the consultation, we will provide you with an overview of your borrowing capabilities and assist you in preparing for your financial future through 2026. Also, follow us on LinkedIn and Instagram to stay updated.