Australia’s Housing Crunch: Prices Up, Rents Tight and What It Means for You

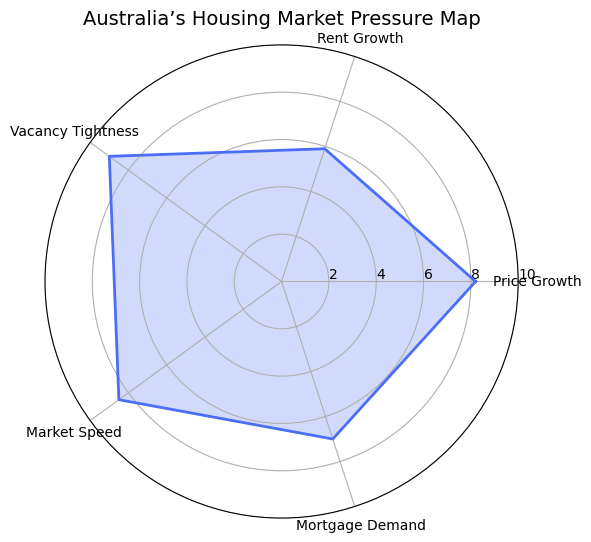

Australia’s housing market remains under pressure. Recent data from NAB’s new Housing Monitor shows capital-city home prices jumped about 8.2% in 2025, lifting the national median price to roughly $900,000. Even rental markets are stretched: advertised rents rose about 5.9% (annualised) late last year, while vacancy rates hovered at record lows (~1.6%). In short, demand is outpacing supply – homes are selling very quickly (median time on market just 28 days) – and new home construction isn’t keeping up. Even though mortgage rates have eased (around 0.75% lower than early 2025), high prices and tight rents mean many buyers and renters feel the squeeze.

What This Means for Borrowers

- Strong competition for affordable homes. Government deposit schemes (like the 5% deposit first-homebuyer scheme) are stirring the lower-price market. In fact, the 5%-deposit scheme is fueling a surge in buyers under about $1M. More people can enter with a small deposit – but that also means bidding wars at the entry level. If you’re a first-home buyer or have a modest budget, be ready for stiff competition. Even with a low deposit scheme, lenders still require you to meet income and serviceability rules. In many popular suburbs (especially inner Sydney/Melbourne) prices are very high, so it pays to be realistic about your loan size and repayments.

- Budget carefully and plan your borrowing. With prices so high, your borrowing power is effectively squeezed. Lenders have become more cautious: from Feb 2026 APRA will cap new loans above a 6× debt-to-income ratio. In practice, that means very high-debt loans (for investors or high earners) will be limited. If you plan to borrow a lot (for investment or a big home), talk to us early. We can help you adjust your loan structure (higher deposit, smaller loan) to stay below that cap. It’s also wise to build extra buffer in your repayments in case rates shift.

- Check your equity and refinancing options. Homeowners have gained equity with rising prices – this can work to your advantage. A higher current value means your loan-to-value ratio (LVR) may be lower than before, potentially saving you on lender’s mortgage insurance (LMI) if you refinance. Now is a good time to review your loan. Consider switching to a more stable rate (many people are fixing longer-term since further RBA cuts seem unlikely), or refinancing to a better deal. Even a small drop in your interest rate or monthly payment can add up over time. Our brokers can shop around dozens of lenders to find the best terms for your situation.

- Renters face rising costs. If you’re renting, be aware the market isn’t easing. High demand and record-low vacancies are pushing rents up. Consider securing a fixed-term lease now or talking to a broker about whether getting into the market (if you can afford it) might save you money long-term. We can help you compare options (perhaps buying a smaller property or in a different suburb) versus continuing to pay high rent. Even small savings on rent can help you boost savings or prepare a deposit.

Every household’s situation is unique. These trends highlight why expert loan advice is more important than ever. As mortgage brokers, we help you understand the changing rules, compare loan options, and make informed choices.

At OM Financials, we make the home loan process easier and guide you through each step. Talk to our brokers today to find out how much you can borrow in this market. We can look over deposit strategies, including government schemes, as well as loan types and interest rates, so you can proceed with confidence. You can book your free consultation or call us anytime at 0478 876 967 to explore your options. You can also follow us on LinkedIn and Instagram.