Cotality Data Highlights Why Finance Readiness Matters

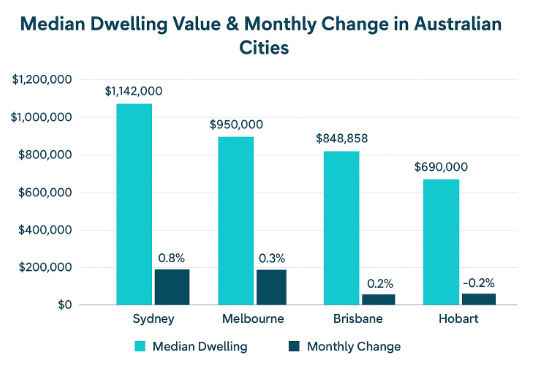

New information from Cotality demonstrates Australia’s property market is regaining speed, resulting in an increased sense of urgency for buyers and investors to prepare their finances. National dwelling values increased by +0.7 in August 2025, the largest monthly increase since May 2024, with the median value now $848,858 (Yahoo Finance, August 31, 2025). Brisbane led the way with +1.2, followed by Sydney (+0.8) and Melbourne (+0.3) and only Hobart with a small decline (–0.2).

Big Changes Ahead for First-Home Buyers

Starting October 1, there will no longer be a cap on how many guarantees can be issued, so every qualified buyer can secure a spot. The cap on how much you earn is gone, too, letting higher-income buyers join in for the first time. The scheme still asks for a 5% deposit, but now you can do it without the extra fee you usually pay for Lender’s Mortgage Insurance (LMI), which means you pay a lower starting cost and you can use more of your savings for the home you want, not for lender insurance, especially helpful with prices still going up and everyday bills still tight.

In the latest update, Sydney and its regional centres jumped to $1.5 million. Melbourne and the nearby Victoria regions have increased to $950,000. In Queensland, Brisbane and major regional hubs now cap at $1 million.

source: Values highlight the growth in property markets and justify the Home Guarantee Scheme updates

Impact on Regional and Urban Markets

Including regional areas in the primary limitation is intended to streamline the home-loan process for buyers beyond the capital. Anticipated is a gradual redirection of first home demand toward the cities, where titles that the property sector branded as unaffordable will now qualify. Adding the higher ceilings on the metropolitan fringe and in heavily spirited regions invites new cohorts of buyers, urban consultants, professionals, and families, encouraging a mild but steady rebalance between metropolitan hubs and nodes that were ranked as fringe previously.

A Timely Policy Win for Housing Accessibility

To wrap up, the Government’s expanded Home Guarantee Scheme in Australia is a practical answer to the ongoing challenge of affordable homeownership.This not only helps families secure long-term stability but also energizes the mortgage sector and strengthens brokers’ positions as trusted, knowledgeable guides.

Mortgage brokers in Australia now is the time to help your clients gear up for the October 1 deadline. Use Housing Australia’s online tools to check client eligibility, then connect with the lenders that will be part of the program.OM Financials will assist you in your investment repositioning with expert financial analysis. Gain insights on the right measures to take concerning property placements all over the globe. Call OM Financials at 0478 876 967 and book a tailored session. For customised strategies, get in touch with us for the most up-to-date guides and resources.