A key enhancement of the forthcoming Home Guarantee Scheme is the elimination of the annual cap on the index of State guarantee allocations. Previously, the Scheme enforced an annual cap, causing a persistent shortfall that regularly excluded prospective first-home purchasers from programme benefits. Effective October 2025, the cap will be abolished, and every eligible applicant will be invited to participate, contingent solely upon a 5% deposit condition and adherence to overall purchase specifications.

Market rationales suggest that the removal of a fixed enrolment ceiling will augment aggregate buyer demand, as prospective purchasers will no longer confront a scarcity-driven auction effect generated by annually constrained–though already limited–first-home Guarantee allotments.

Elimination of Income Caps

A parallel reform is the rescission of income bands that had formerly restricted buyers. The prevailing policy had excluded candidates whose earnings surpassed specified thresholds, notwithstanding the inadequacy of savings patterns. From October 2025, the Scheme will glide upwards of the earlier fixed bands, thus admitting buyers with comparatively higher incomes, and removing a criterion that failed to correlate with genuine affordability difficulties encountered by deposit savers.

The policy objective is to increase the net benefits available to participants located in metropolitan centres, where property values at entry level commonly exceed prevailing regional norms, and deposit savings rates have proportional instability. As a result, first-home buyers in high-value urban conglomerates, including Sydney, Melbourne, and Brisbane, will retain definitive entry to government-supported financing irrespective of their income levels. For more information regarding first homebuyers government guaranteed schemes click here

Higher Property Price Caps

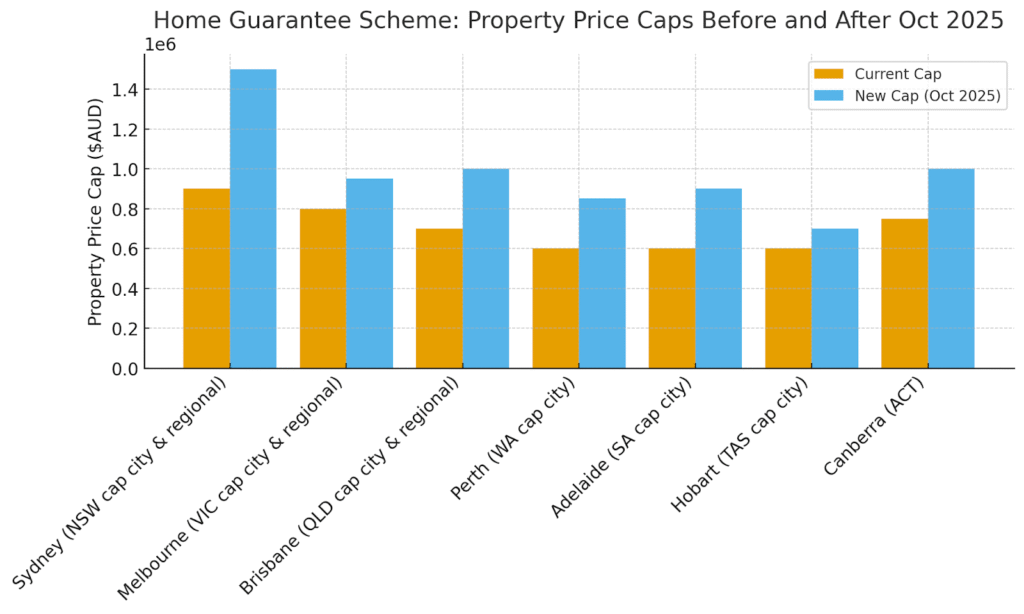

In response to strong growth in residential prices nationwide, the Government has delivered a broad revision of the property price caps underpinning the First Home Guarantee scheme.

- For Sydney as well as the major centres of regional New South Wales, the new price threshold is set at $1.5 million, a lift from the previous ceiling of $900,000.

- In Melbourne and the city of Geelong, the limit has been raised to $950,000 from $800,000.

- For the metropolitan areas of Brisbane, the Gold Coast and the Sunshine Coast, the new figure is $1 million compared with the earlier $700,000.

- In Perth, the ceiling is $850,000, an increase from $600,000.

- South Australia now has a cap of $900,000, with the previous limit at $600,000.

- For Hobart, the adjustment is to $700,000 from $600,000.

- Canberra has been set at $1 million, rising from the former $750,000.

- Regional jurisdictions of Western Australia, South Australia, Tasmania and Queensland will likewise receive material uplifts in their price caps, while smaller jurisdictions, including the Northern Territory and the external territories, will remain as before. source.

These adjusted ceilings will enable first-home purchasers to examine properties that were earlier deemed unaffordable within the earlier framework.

Omni-Lender Availability

The Home Guarantee Scheme persists through a curated eco-structure of 30-plus accredited lending institutions, spanning member-owned financiers, territorial lending hubs, and federated banking entrants. By August, the maximum eligible property price ceilings and by annulling both geographical and household mean income constraints, the federal authority has sought to abrogate two of the principal frictions impeding the entry of first-time purchasers.

Deposit from 5% Without Lenders Mortgage Insurance

The Home Guarantee scheme retains its capacity to offer access to the market at a 5% deposit, with an exemption from lender’s mortgage insurance. For a substantial cohort of first purchasers, LMI can add several tens of thousands of dollars to the cost of borrowing at a modest deposit. By alleviating this expense, the program facilitates the transition to homeownership at a lower overall cost.

OM Financials stands ready to service your tailored financial strategies and expert insights whether you are a first-time homebuyer or an investor looking to expand your portfolio and review your existing mortgage. It is time to plan and strategically anchor yourself in a recovering market. Call 478 876 967 or book an appointment to secure your consultation.