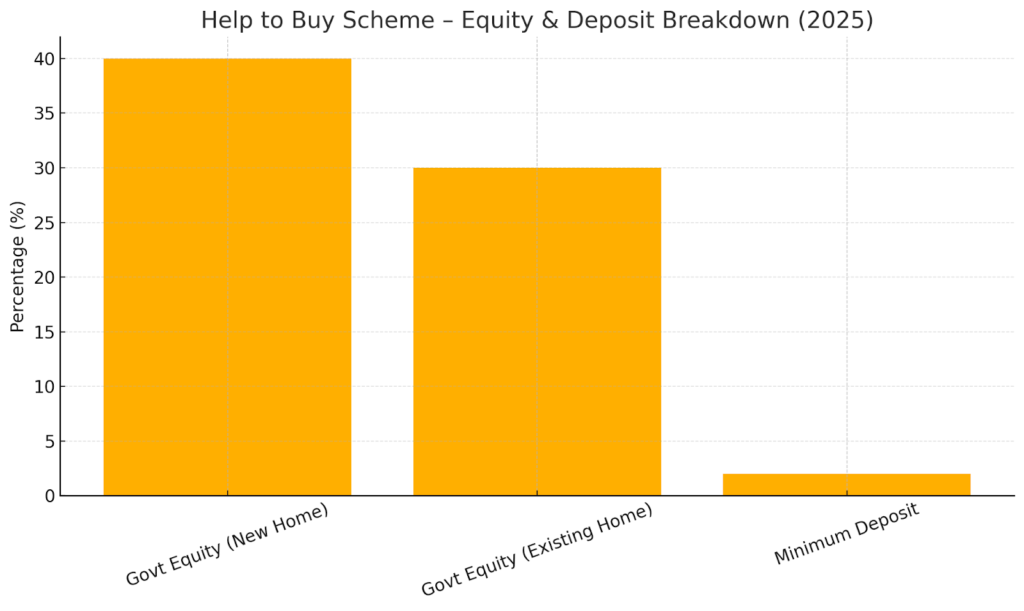

The Albanese Government’s long-awaited Help to Buy program launches on 5 December 2025, opening applications in the participating states and territories. This federal shared-equity scheme will run for four years with up to 10,000 places each year (40,000 total). It helps eligible home buyers (first-timers and those re-entering the market) by reducing how much of cash and debt they need. Under the scheme, Housing Australia (on behalf of the government) will contribute up to 40% of the purchase price on a newly built home, or 30% on an existing home. In practice, this means a buyer needs only a 2% deposit (of the home’s price) to participate. By bridging the gap between savings and property prices, Help to Buy dramatically cuts the loan size needed (and also avoids lenders’ mortgage insurance). The buyer fully owns the home, but the Commonwealth shares in any future gains or losses on that equity until the stake is bought out or the home is sold.

- Eligibility: Only owner-occupiers (no investors) can apply. Applicants must be Australian citizens meeting income caps (up to $100,000 pa for singles, $160,000 for couples or single parents). They also must have saved at least 2% of the purchase price (to contribute as a deposit) and meet other criteria (e.g. being 18+, not already owning property, and living in the home as their principal residence).

- Property types and caps: Eligible purchases include a new or existing house, townhouse, apartment, unit or duplex. A vacant lot for a new build (or a home being demolished and rebuilt under contract) also qualifies. Each location has a price cap to keep the scheme targeted (e.g. up to ~$1.3 million in Sydney/NSW, $1.0 million in Brisbane/QLD, $950k in Melbourne/VIC, etc). (Notably, WA and Tasmania have yet to pass laws to participate.)

- Combination with other schemes: Borrowers can still use stamp-duty concessions, grants or the First Home Super Saver Scheme alongside Help to Buy. However, they cannot double-dip into other shared-equity or government guarantor schemes at the same time.

Market impact – FHB demand and investor perspective

By making home loans possible with just a 2% deposit and no LMI, the scheme is expected to trigger a surge of first-home buyer (FHB) demand. Market commentators note that similar low-deposit measures have led to a rush of buyers scrambling for affordable homes. In the current environment, brokers are already hearing reports of FHBs “panic buying” – bidding sight-unseen and overpaying – to lock in a place under the scheme. Agents across the country warn that demand for entry-level properties (especially in the $600k–$800k range) is pushing price guides higher and hastening sales. For example, one report found that “[f]irst home buyers are proving competitive against investors, particularly given the low stock levels and limited quality of available properties”.

For mortgage brokers, this dynamic has two sides. On one hand, clients under Help to Buy will have smaller loans (e.g. with a 2% deposit on an $800k home, the broker example shows an LVR of about 68%) and no LMI, which generally eases serviceability. On the other hand, rising FHB demand may mean stiffer competition in the usual investor hotspots. Entry-level suburbs are likely to see sharper price growth, meaning investors may need to look farther afield or pay closer attention to yield vs. capital growth. Brokers should review loan products and serviceability rules carefully: some lenders may remain conservative on investor loans even as FHB loans flow under Help to Buy.

How OM Financials can helpAt OM Financials, we’re tracking the Help to Buy rollout closely. Our mortgage brokers can explain how the shared-equity scheme works for your clients, and help tailor their borrowing strategy. Speak to our expert brokers today, we’ll compare loan offers across 50+ lenders, clarify your borrowing power under current rules, and plan a strategy to achieve your goals. Call us anytime at +61 478 876 967 or visit our website to book a free consultation.