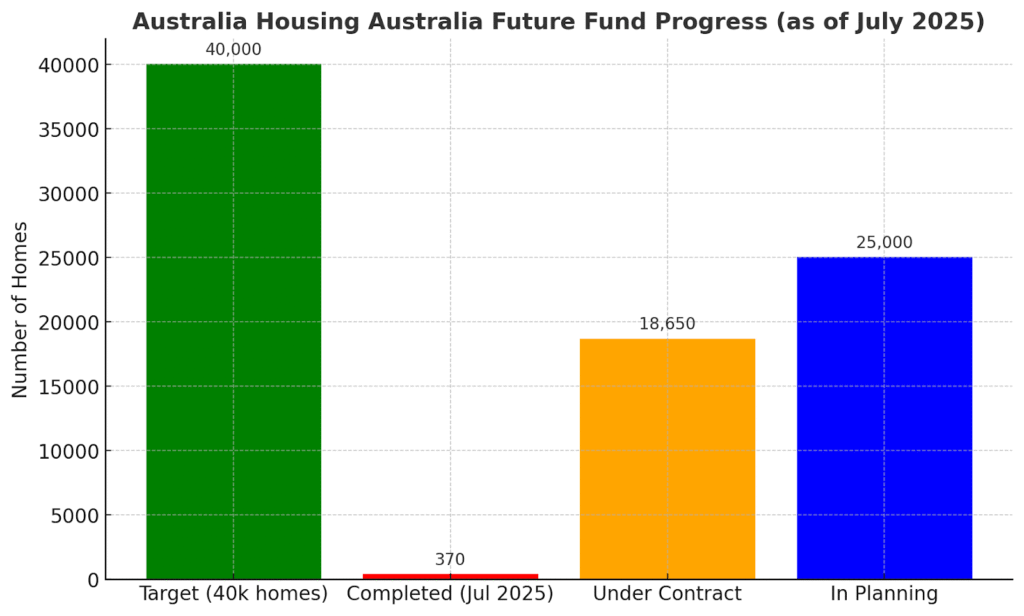

Australia’s housing agenda remains ambitious but outpaced by reality. The government’s $10 billion Housing Australia Future Fund was meant to support 40,000 new social and affordable homes over the next 4–5 years. Yet progress has been slow: by July 2025 only about 370 homes were completed under this policy. Housing Australia reports that about 18,650 homes are under contract (with $14.0 b committed) toward that 40k goal, but that still leaves a long way to go. Minister Mark Butler notes roughly 25,000 homes are in various planning stages, but Senate delays set projects back by about a year. In short, political holdups have pushed out the build schedule.

Limited stock & fierce competition

In practice, the housing market remains short of stock, so buyers face fierce competition for properties. Recent data from LJ Hooker shows new listings are about 18% below the ten-year average. Fewer homes on the market means multiple bidders are common at auctions and over-the-phone negotiations. Sellers hold the upper hand, as clearance rates in major cities have surged. In this tight market, finance readiness is crucial. Mortgage brokers advise buyers to:

- Get pre-approved early. An approved loan in hand signals you’re a serious bidder, and it lets you act fast on new listings. Pre-approval also locks in a rate for a period, potentially saving thousands in interest over time.

- Use the 5% deposit scheme if eligible. The expanded First Home Guarantee now lets qualifying first-home buyers borrow up to 95% of a property’s price. As Minister Butler pointed out, this “cuts years off” saving time. In practice, it means you can enter the market with only a 5% cash deposit, saving on lenders’ mortgage insurance (LMI) fees.

- Lean on your broker for a loan strategy. In an undersupplied market, how you structure the loan can make a difference. Brokers can recommend tactics like splitting repayments, using an offset account, or adding a guarantor to boost borrowing power. We help clients tailor their loan mix so they can make the strongest offers even when competition is high.

Why mortgage strategy matters

Importantly, funding schemes alone won’t fix Australia’s affordability crunch. Even with government support, the fundamental issue is supply. That means a smart finance strategy is essential. Mortgage brokers play a key role: we stay on top of each lender’s criteria and use market data to advise clients. In today’s market, we stress building a strong application early – clear any debts, save a little extra buffer, and apply for pre-approval. We also discuss loan features: for example, an offset account can reduce interest costs over the life of the loan, and an interest-only option might help manage cash flow in the first years. These decisions are especially important now, since a low deposit also means less repayment flexibility.

In short, don’t leave your loan to chance. Talk to a broker about every available option: lock in your finance, use the 5% deposit scheme, and plan your loan structure so you can act confidently.OM Financials is known for making the loan process simple and guiding you every step of the way. You can also book a free consultation or call us at 0478 876 967 to know more. We are always available to guide you.