Recent data shows Australia’s housing market is still growing, but at a slower pace. CoreLogic’s Cotality index reports national home values rose 1.0% in November – a strong rise but down from October’s 1.1% gain. The lift is driven mainly by smaller capitals. Perth led the gains with a 2.4% jump, thanks to very tight supply and strong demand. In contrast, Sydney (+0.5%) and Melbourne (+0.3%) saw much smaller increases, reflecting affordability pressures.

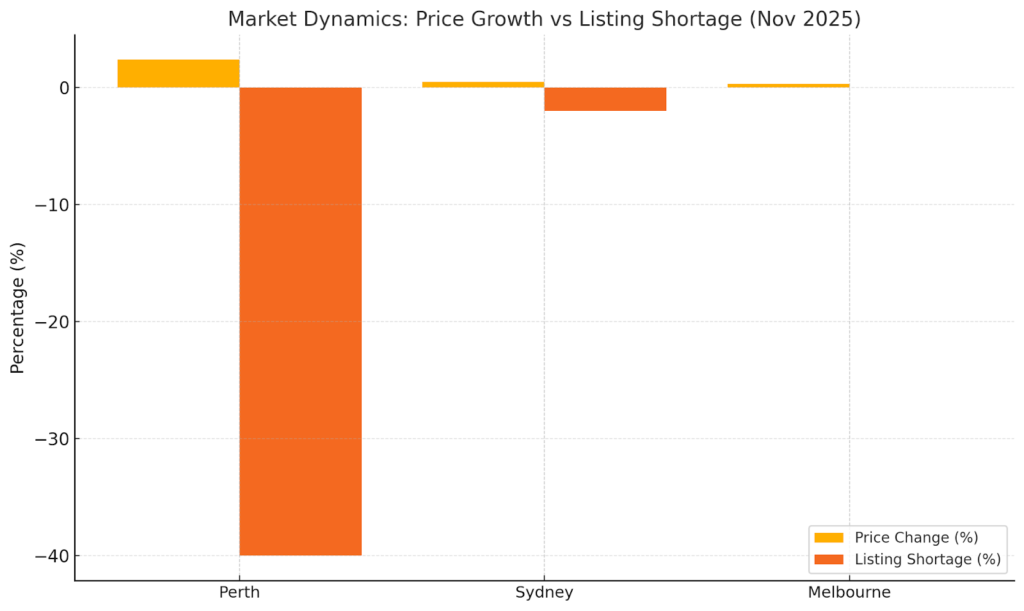

Many suburbs in Perth and other mid-sized markets are seeing steep price rises as listings fall and buyers compete for homes. Perth’s listings were about 40% below average, helping push its median house price up roughly $21,000 in November. By comparison, Sydney’s listings are barely below long-term norms (around 2% under average), so growth there is more muted. Low auction clearance rates also signal cooling momentum – clearance rates have slipped below decade averages in recent weeks.

At the same time, affordability is at record lows. Nationally, the median house is now worth about 8.2 times the typical household income, and the median mortgage requires roughly 45% of pre-tax income to repay. These stretched ratios mean many borrowers will struggle to qualify for loans under the current serviceability tests. With inflation back above target and further rate cuts unlikely, lenders may hold firm on interest rates. The combination of higher repayments and low listings is expected to put a dampener on housing sentiment.

APRA’s new lending rule will add to this tightening. From February 2026, new home loans with debt-to-income ratios above six (i.e. loans of more than 6× borrower income) will be capped at 20% of all new lending. This affects both owner-occupiers and investors. Most current borrowers are well under this threshold, but investors and high-income buyers will need to adjust. In short, banks will become more cautious about very high-debt loans, especially on expensive properties.

What This Means for Borrowers

- Housing values are up, but borrowing power may not rise equally. The recent rise in home prices boosts equity for existing homeowners, but first-home buyers face higher price tags for the same size loan. If you’re buying, factor in that lenders now require higher buffers. It’s wise to review your loan type: many borrowers are switching from variable to longer fixed rates for stability, since rate cuts seem unlikely.

- Check your LVR and insurance. Rising values mean your LVR (loan-to-value ratio) might be lower than when you borrowed. This can save you on LMI (lender’s mortgage insurance) if you refinance. If you can top up your deposit or reduce debt, you gain better borrowing capacity. Now is a good time to talk to your broker about refinancing options or fixed-rate deals.

- Plan for the DTI cap. Investors or high-earning borrowers with multi-year loans should note the upcoming APRA cap. Keep your loan structure simple (for example, lower loan amounts or higher deposits) to stay well under a 6× income ratio. If you plan to borrow heavily, do it sooner rather than later.

- Tap equity carefully. If your home value has gone up, you may have equity to reinvest or renovate. But balance that with serviceability – taking on extra debt at today’s rates means higher repayments. Brokers can help model scenarios (e.g. interest-only vs principal-and-interest, fixed vs variable, offset accounts) to see what’s safe.

- Market differences: realistic expectations. In Perth and many regional areas, strong demand means opportunities for growth; investors there may see faster gains. In Sydney/Melbourne, growth is much slower – borrowers should set realistic budgets and possibly look outside the inner city for better value. Remember, a mortgage broker can run different scenarios and check exactly how much you can borrow under today’s rules.

At OM Financials, we help people navigate these changes. We make the loan process simple and guide you every step of the way. If you’re buying, refinancing or just want to know your options, book your free consultation now or contact us anytime at 0478 876 967. Speak with our expert brokers today to understand your borrowing power and move forward with confidence. You can also follow us on LinkedIn and Instagram to stay updated with market trends.