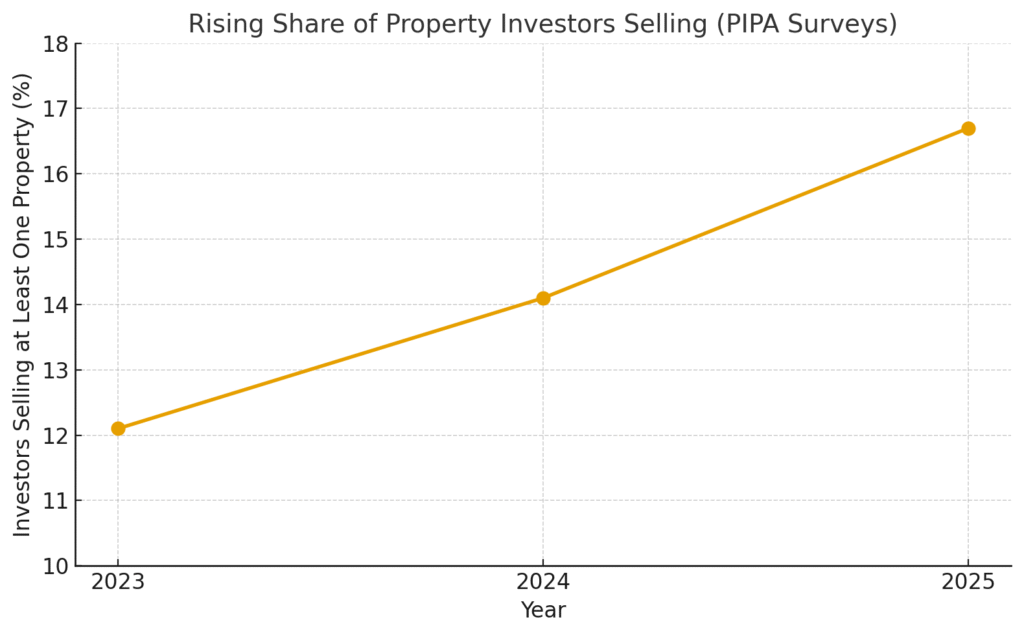

There’s a bit of a shake-up happening in the property market right now. More and more landlords are throwing in the towel and selling. A survey from the Property Investment Professionals of Australia (PIPA) found that almost 17% of investors sold at least one place in 2025. That’s up from 14% last year, and 12% the year before. It’s not slowing down – it’s speeding up.

Why does this matter? Well, when investors sell, a lot of those homes stop being rentals. They get bought by families or first-home buyers instead. And once a place is no longer a rental, it usually doesn’t come back. That means fewer properties for tenants, and rent pressure just keeps climbing. Realestate.com.au even called it a “record exodus.”

What the survey picked up

- Lots of selling: Nearly 17% of investors sold in the past year. The biggest number since PIPA started keeping track.

- Who’s buying them: About 42% went to other investors. The rest? Mostly families moving in themselves and first-home buyers.

- Rent squeeze: PIPA highlights that investor exits are reducing the rental pool with “severe” implications for renters.

Why are landlords walking away?

Investors cite multiple pressures pushing them to sell. The PIPA survey highlights these top reasons:

- Debt pressure. Around 4 in 10 said they just needed to cut down their debt.

- Rising costs. Interest rates, repairs, insurance, strata fees – you name it, it’s gone up. Some investors say their yearly costs jumped by as much as 40%.

- Taxes. Land tax and other government charges are taking a bigger bite.

What This Means for Borrowers and Brokers

Here’s where it affects borrowers and brokers:

- Refinancing is hot right now. Many investors who aren’t selling are shopping around for better rates. Switching banks or splitting loans can help cut repayments.

- Structuring matters. With rules changing, it’s worth checking how your loans are set up. The right structure can save headaches if policies shift again.

- Sell or hold? For some, it makes sense to sell and pocket the gains. For others, refinancing to ride it out might be better. A broker can run the numbers both ways.

- First-home buyer window. With more properties leaving the rental pool, buyers actually have more choice. If you’re looking for your first place, it’s worth getting pre-approval sorted now.

Where OM Financials fits in

At OM Financials, we try to make all this less confusing. Whether you’re thinking of selling, refinancing, or buying your first place, our brokers can lay out your options in simple terms. We’ve got access to over 50 lenders, so it’s not just one bank’s product on the table.

We’ll help with things like refinancing to cut repayments, setting up split loans, or even short-term finance if you’re selling and buying at the same time. Most importantly, we’ll explain it clearly so you know exactly what you’re signing up for.Looking ahead? Feel free to contact OM Financials anytime. You can either book a free consultation or call us anytime on +61 478 876 967 to discuss your borrowing power and finance strategy. Our team is here to provide clear, practical advice in this changing market.