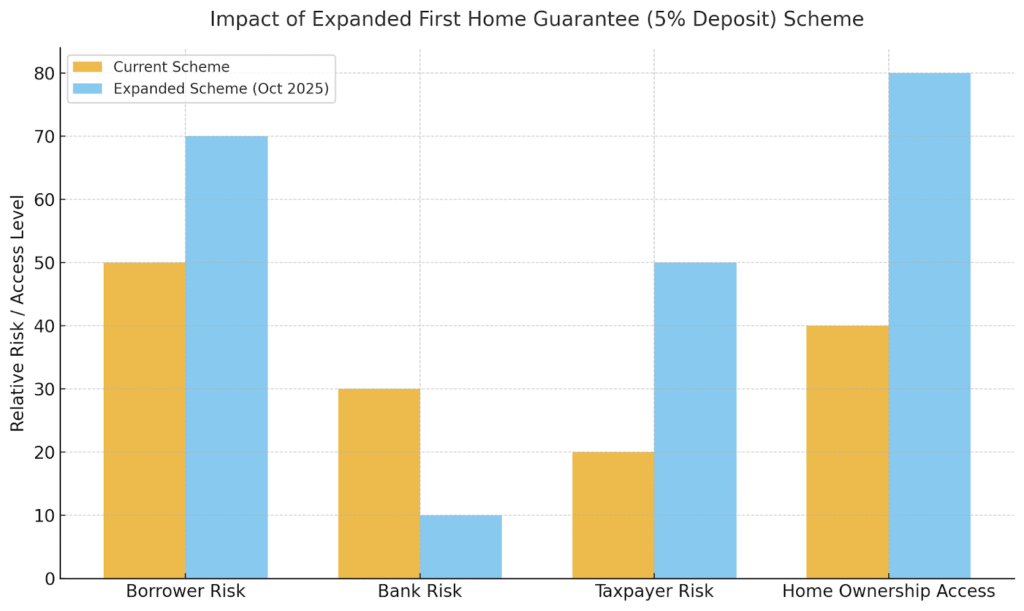

RBA Governor Michele Bullock was recently questioned at a Senate hearing about the federal government’s expanded First Home Guarantee (5% deposit) scheme. She agreed it could lead to riskier loans, noting borrowers will have “a much higher loan-to-valuation ratio” and could end up in negative equity if prices fall. The scheme lets eligible first-home buyers enter the market with just a 5% deposit and no lenders’ mortgage insurance. From October 2025, all first home buyers will qualify (old income and place caps are gone). This makes it much easier to buy sooner – but it also shifts more risk onto borrowers.

Bullock warned that removing income caps means more buyers may take on bigger debts. Those with high loan-to-value or debt-to-income ratios will face much higher repayments, so they must think carefully about affordability. She noted not everyone will rush to the 95% limit – many buyers “think before they borrow up to the maximum they’re allowed”. Still, with the government now guaranteeing these loans instead of private lenders, any shortfall (if prices fall) ends up on taxpayers, not the banks.

Importantly, the RBA emphasised that the real driver of rising prices is the lack of homes, not interest rates. Chronic undersupply is expected to continue for at least the next two years, keeping competition for housing very strong. Growing investor demand (investors often lead market cycles) could add further pressure. In this hot market, brokers have a crucial role in keeping borrowers safe.

Brokers’ advice to buyers:

Buying a home can feel confusing, but the right steps can make it easier. Here are some simple tips from brokers to help you get ready and buy with confidence:

- Get pre-approved early. Lock in your borrowing power and rate so you can act fast when the right property comes up.

- Use the 5% deposit scheme wisely. If you qualify, this lets you buy sooner and saves on LMI. Just be sure you can afford the larger 95% loan.

- Be mindful of loan size. A very high LVR means a small equity buffer – if values dip, you could owe more than your home is worth. Always budget with room for surprises and don’t overstretch your repayments.

- Manage your repayments. A high debt-to-income ratio means higher bills. It is also important to keep your eye on the features of the loan as well in order to manage your monthly burden. Additional repayments can also build equity faster and provide you with a safety net in the early stages of your loan.

- Lean on your broker. We compare the lenders and help structure your loan correctly. We’ll let you know what you can comfortably afford and then find you the best ones.

At OM Financials, we make the loan process simple and guide you every step of the way. We stay up-to-date on policy changes and lender rules so you get personalised advice. Speak with our brokers today to understand your borrowing power and options. Book a free consultation now or call us on 0478 876 967 to explore strategies that work for you.