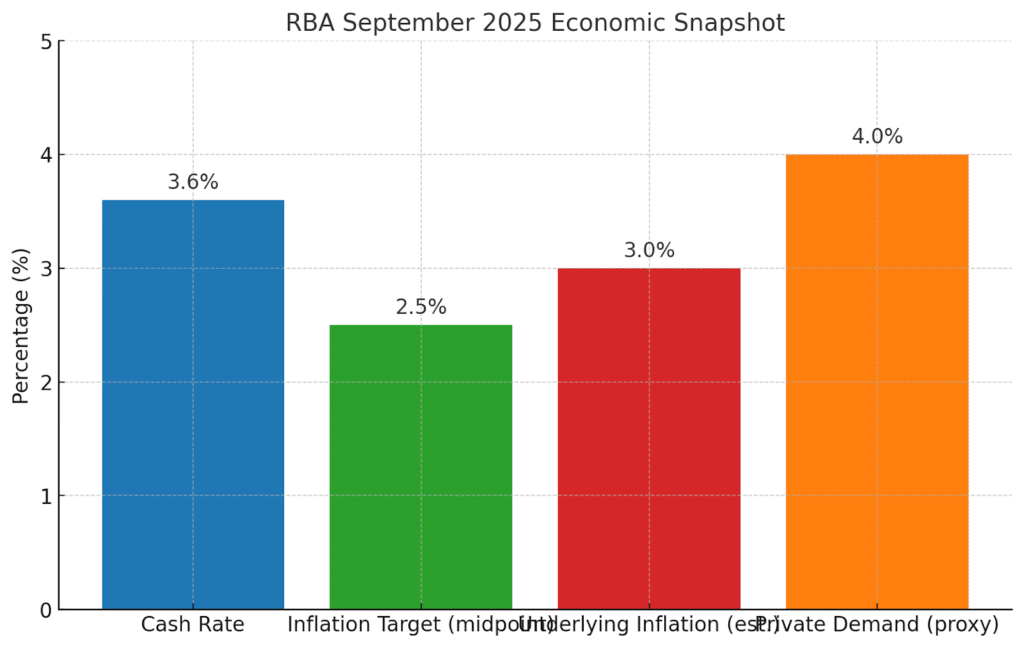

The Reserve Bank has again held the official cash rate at 3.60%. In its September statement the Board noted that inflation is still within the 2–3% target range, but its decline has slowed. In fact, recent data suggest underlying inflation may be a bit higher than expected, especially in services and housing costs. At the same time the RBA points out that private demand is firming – household spending and the housing market are picking up. In short, the Bank is remaining cautious: it wants to see more data (especially next quarter’s CPI and job numbers) before deciding on further rate cuts.

Financial markets took the decision as mostly expected, but turned a little hawkish afterwards. Traders have now trimmed bets on a November rate cut: swaps imply only about a 30–36% chance of a move by the end of the year, down sharply from roughly 50% before the statement. The Australian dollar even rose (to around US$0.66) on the news, and the stock market (ASX 200) slipped slightly (about 0.2%). In other words, investors are thinking the RBA will hold rates steady for longer, unless new data gives a clearer signal.

Must Know Tips for Property Buyers

Given this backdrop, here are some practical tips for mortgage holders and property buyers:

- Refinance now if you can. With competition among lenders returning, many borrowers are refinancing to lower rates. In fact, experts note most variable-rate mortgages are already below about 5.5%. If you’re paying more than that, you may be losing thousands over time. Talk to your broker about switching to a better deal, or restructuring your loan (for example, splitting part of it to a fixed rate). Even if the RBA cuts rates again, acting now could lock in savings.

- Model different scenarios. Plan for either rate outcome: one more cut or none. Sit down with your broker to see how your repayments change if the rate stays at 3.60% versus a possible 3.35% in November. This can guide decisions like choosing between fixed vs. variable or timing a home purchase. Having a clear picture of “best case” and “worst case” cash flows will help you budget and avoid surprises.

- Use cash-flow tactics. Consider using an offset or redraw facility to save on interest. You might also split your loan with part fixed/part variable to balance security and flexibility. If you expect income fluctuations (e.g. due to bonuses or seasonal work), smoothing your loan repayments by paying extra when you can and drawing on offset when needed can help manage budget bumps.

- Stay disciplined with pre-approvals. A held rate doesn’t guarantee lower home prices ahead. Supply is tight and buyer competition is still strong. Even though borrowing costs might have topped out, properties in good areas can keep getting multiple offers. Keep your lender’s serviceability buffer in mind: don’t treat your pre-approval as a blank cheque.

- Mind the risks. With uncertainty over further RBA moves, maintain a healthy repayment buffer. Banks still stress-test loans at higher rates (often 7–7.5%). Make sure you could handle that sort of rate if cuts take longer or inflation resurges.

At OM Financials we understand this can all be overwhelming. We’re here to help. Feel free to book a free consultation or call us on 0478 876 967. Let us show you how much borrowing power you really have in today’s market – you might be surprised at what’s possible.