Mortgage Repayments and Inflation: What Borrowers Need to Know

Official inflation figures (CPI) may not reflect your rising home loan bills. Since 1997, the ABS has excluded mortgage repayments from the CPI after the RBA asked for the change. In other words, increases in your mortgage payments don’t show up in headline inflation. This is common practice globally, so official inflation can fall even while your mortgage costs climb.

Impact on borrowers

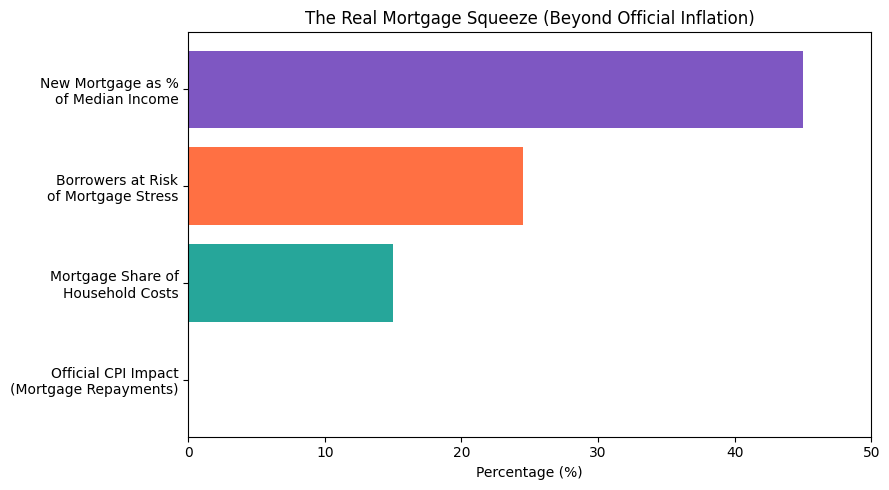

For many Australians, the gap between official inflation and actual costs is very real. Banks have already raised payments on an average $600,000 home loan by about $90 a month with the latest rate hike. Those higher interest costs carry weight: mortgage interest makes up roughly 15% of a mortgaged household’s cost-of-living, almost as much as the food and groceries category. New borrowers are facing payments of around 45% of their median income on their mortgage alone.

- Average $600k mortgage repayment up ~$90/month after the recent rate rise.

- Mortgage interest is about 15% of household expenses for borrowers.

- Paying off a new home loan uses roughly 45% of the median income.

- About 1.19 million Aussies (24.5% of borrowers) were at risk of mortgage stress in late 2025, and another 41,000 are expected to join them after this hike.

These figures show why many borrowers feel squeezed: working people often “simply can’t keep up with mortgage repayments and the rising cost of essential items,” meaning CPI is the least of their worries.

Rate rises & serviceability

When the RBA raises rates, the goal is to slow spending by making borrowing costlier. Borrowers feel this effect first – higher rates mean bigger mortgage bills, which force cutbacks in household budgets. In fact, the RBA notes that many have already cut back on spending to cover higher mortgage payments.

Importantly, lenders still base loan approvals on your full mortgage repayments, not just CPI. A loan with a tight budget or no financial buffer can become hard to manage as rates climb. Every dollar of debt still counts, even if “official” inflation doesn’t include it.

Why expert advice matters

Now more than ever, good mortgage advice is invaluable. Brokers help you plan for rate rises by stress-testing your repayments – for example, we’ll check how higher rates or a bigger loan size would impact your budget. We also structure your loan for flexibility: using offset accounts or splitting between fixed and variable rates can reduce interest costs and provide buffers. If a better deal is out there, we can recommend refinancing. Even if official inflation is steady, your personal cost of living may still be rising – an expert broker helps bridge that gap.

How OM Financials can help

At OM Financials, we understand mortgage stress is real. Our expert brokers compare 50+ loan options to find one that suits your needs. We’ll walk through “what if” scenarios with you: if rates go up, will you cope? Do we need to add an offset or fix part of the loan? We handle the paperwork and lender negotiations so you don’t have to worry.Speak with our brokers today to understand your new borrowing power and keep your mortgage on track. Book a free consultation or call us anytime at +61 478 876 967. At OM Financials, we make the loan process simple and guide you every step of the way. Let us help you stay ahead of rate rises and protect your home loan balance. Don’t forget to follow us on LinkedIn and Instagram.