When you borrow for property, choosing between an Interest-Only (IO) loan and a Principal & Interest (P&I) loan is one of the most […]

Blog

Recently, in suburbs like Riverstone, an increasing number of first-home buyers are adopting a hybrid strategy often dubbed “rentvesting”—renting in their preferred lifestyle […]

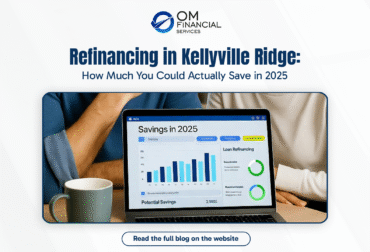

As we step into 2025, economic forecasts point to a potentially crucial window for mortgage holders to secure some of the better terms. […]

RBA Governor Michele Bullock was recently questioned at a Senate hearing about the federal government’s expanded First Home Guarantee (5% deposit) scheme. She […]

Self-Managed Superannuation Funds (SMSFs) are often considered the best option for achieving control, tax advantages, and targeted growth in wealth creation. Yet their […]

The Reserve Bank has again held the official cash rate at 3.60%. In its September statement the Board noted that inflation is still […]

Australia’s housing agenda remains ambitious but outpaced by reality. The government’s $10 billion Housing Australia Future Fund was meant to support 40,000 new social […]

Entering the housing market can feel like traversing a complicated labyrinth. With fluctuating prices, competitive bids, and a sea of loan options, the […]

There’s a bit of a shake-up happening in the property market right now. More and more landlords are throwing in the towel and […]

Securing a personal loan can be a pivotal step toward achieving your goals, whether that’s consolidating debt, funding a major purchase, or covering […]