Self-Managed Superannuation Funds (SMSFs) are often considered the best option for achieving control, tax advantages, and targeted growth in wealth creation. Yet their complexity demands careful management, even as they create structures for retirement wealth generation. However, using SMSF to borrow for property—known as a Limited Recourse Borrowing Arrangement (LRBA)—is one of the most complex and heavily regulated areas of superannuation. Moreover, understanding the legal framework is crucial for many sophisticated investors who are exploring opportunities in Sydney’s growing Northwest, including Annangrove’s acreage lifestyle, the modern estates of Kellyville Ridge and North Kellyville, and the eye-catching beauty of Beaumont Hills & Box Hill.

Here, OM Financials enters the market as the game-changer with its specialized financial expertise, understanding that the strict compliance framework of SMSF lending is not just recommended—it is absolutely essential for property investment.

Regulatory Framework: Rules of SMSF Limited Recourse Borrowing

The process of securing an SMSF loan is fundamentally different from obtaining a standard residential mortgage. The central regulatory mechanism governing this practice is the Limited Recourse Borrowing Arrangement (LRBA).

An LRBA mandates that the borrowing must be used to acquire a single, identifiable asset (or a collection of identical assets) held on trust. The ‘limited recourse’ aspect is very vital: should the SMSF default on the loan, the lender’s recourse is strictly limited to the acquired property itself in some manner and cannot extend to the other assets held within the super fund.

Key Rules and Limitations under an LRBA:

- Limited Recourse: The lender’s recourse in the event of default is quite limited to the single asset being purchased and held in a separate bare trust. If the loan somehow goes into default, the lender cannot access the fund’s other assets (shares, cash, or other property). This very protection for the fund is why SMSF interest rates are typically higher than conventional residential mortgages.

- Single Acquirable Asset: The borrowed money must be used to acquire a single, specific asset or a collection of identical assets (like a parcel of shares). The property cannot be subdivided or fundamentally changed until the loan is paid off.

- No Improvements Rule: Loans cannot be used to fund “improvements,” only “repairs” or “maintenance” to the existing asset in any way. Substantial structural changes or additions that change the character of the asset must be funded with cash reserves already held within the SMSF.

- Sole Purpose Test: The investment must strictly be for the sole purpose of providing retirement benefits to the SMSF members. This prohibits members or related parties from residing in or using the residential property.

Benefits and Risks of Property Investment via SMSF

Investing in property through your SMSF, particularly in high-growth areas of Sydney such as the Hills District, offers a deliberate synthesis of financial upsides and inherent risks that must be carefully balanced.

Strategic Benefits:

- Tax Efficiency: Rental income together with capital gains is taxed at concessional rates. During the accumulation phase, income is taxed at a maximum of 15%. If the fund enters the retirement phase, both rental income and capital gains can be tax-exempt.

- Zero Capital Gains Tax (CGT) in Retirement: If the property is sold while the SMSF is paying an account-based pension, the capital gains are effectively taxed at 0%. Even during the accumulation phase, capital gains are taxed at an effective rate of only 10% (for assets held longer than 12 months).

- Control and Transparency: Investors gain complete control over their property selection, loan terms, and management decisions, mainly providing transparency often lacking in pooled superannuation funds.

- Diversification: Property provides a tangible asset class for diversification, strictly helping to spread investment risk across traditional assets like shares and bonds.

Critical Risks:

Cash Flow Management: The fund must maintain sufficient liquidity to meet loan repayments, property expenses (rates, maintenance, insurance), and unexpected vacancies as well, without resorting to selling core assets.

Gearing Risk: Using borrowed money (gearing) broadly amplifies returns but also magnifies losses if the property market declines.

Complexity and Compliance: The LRBA rules are highly technical. Non-compliance can simply result in severe penalties, including stripping the fund of its concessional tax status.

Limited Recourse: While a benefit to the fund’s main assets, the limited recourse nature means banks typically require higher deposit contributions and apply stricter lending criteria in a precise manner compared to standard home loans.

The Local Outlook: Northwest Sydney’s Property Hotspots

The strategic aspect of SMSF property investment is typically most effectively carried out in growth corridors. North-West Sydney continues to demonstrate strong demand, particularly across its expanding estates and suburbs, offering viable opportunities for SMSF property investors.

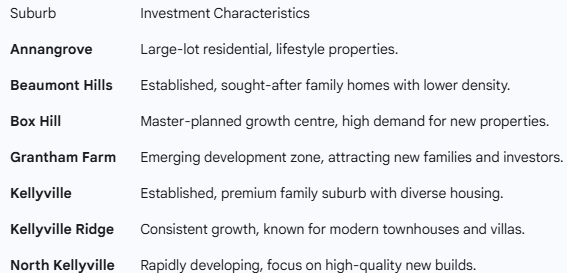

When looking at regions like Annangrove, Beaumont Hills, Box Hill, Grantham Farm, Kellyville, Kellyville Ridge, & North Kellyville, investors are capitalizing on essential infrastructure development & family lifestyle appeal.

End Thoughts: Strategic Partnerships Are Non-Negotiable

Investing in property through an SMSF is a powerful mechanism for future financial security, offering unmatched tax benefits when done correctly. However, the legal and financial complexity demands the assistance of experts. Successfully navigating the LRBA framework, securing competitive rates for your new home loans for Box Hill NSW property.

Call now at +61-478-876-967 or book your free consultation call with OM Financials’ seasoned professionals and take the essential step toward ensuring compliance and maximizing your investment potential with an SMSF property investment strategy.